At 58, you may not be officially a senior yet, but it's right around the corner, and there are some major decisions ahead. You're probably daydreaming about retiring if you haven't already, and may want to start traveling or pick up some new hobbies.

What We'll Cover

If you don't already have life insurance or are considering changing policies, there are some things you need to know, such as how your age and gender will affect your policy, what insurance companies are on the lookout for when it comes to a medical exam, and how much you'll be paying. It's also important to act now when you’re looking for cheap life insurance providers for 58 years old as some companies won't offer policies to anyone over 60.

Now Is the Time to Act

By age 58, you've already hit a lot of milestones. You've celebrated your half-century birthday, bought a forever home, either been long since married or made the decision to fly solo, and have had a solid career in your chosen field. Whether or not you decide to retire or keep working, finding the right insurance policy is something you need to seriously consider.

What’s more, at 58, you've probably gathered a lot of assets, such as a car, home, land, and other valuables that you'd like to pass on to your loved ones. A life insurance policy can ensure that your family gets to keep all that when you're no longer around to take care of them.

It's crucial to act now, however, because some companies won't offer life insurance policies to anyone over the age of 60. As you are getting closer to this mark, it's best to choose a life insurance provider before you are no longer eligible for coverage. It's important to note that many companies offer policies up to age 80, but there are many who do not.

How Much Coverage Do You Need at age 58?

This is obviously a personal question, but there are some ways to figure out how much you need. Since life insurance is primarily used to help pay off debt such as mortgages, loans, and medical bills, you need to determine how much debt your family will be left with.

Many individuals may not be debt free when they are 58 years old, but they've already paid off their student loans, auto loans, and are probably close to paying off their house. If this sounds like you, then figure out how much debt you owe, and go from there.

You should also find out how much it takes for funeral costs in your area. Some states cost far more than others, so a quick search should give you an idea of how much your family will need.

Is There a Way to Lower My Rates?

When shopping around for affordable life insurance providers for people 58 years old, it's important to note that there are some factors that the companies are looking at when determining your rates. While there are some factors you can't change, such as your age, there are some that you can work on.

Insurance carriers aren't exactly as excited to pay out on your policy as they are to sell it to you, so your health will play an important role in determining how much you pay. Proving that you've quit smoking, are exercising, and have lost weight will help. You can also eat healthier and try to lower your blood pressure if you can.

Something else you can do is avoid high-risk hobbies such as sky-diving and horseback riding. This doesn't mean you have to give up on all your passions, but your insurance carrier won't be thrilled to insure you if you think monster truck racing is fun. If you do it a couple of times a year, this will also help.

Picking the Right Cheap Life Insurance Providers for 58 Years Old

There are a lot of insurance providers out there, and all of them will most likely assure you they are the best. Rather than taking their word for it, however, it's best to take a little time to shop around.

Some companies require medical exams, yet others will let it slide for a higher rate. Then there are different policies depending on what you want. Rather than jumping at the first offer you receive, check out a variety of carriers to determine which is the best fit for you.

Some great places to start when you’re 58 years old assessing cheap life insurance providers include:

Sproutt

Sproutt may be new to the insurance world, but it's a good choice for anyone who doesn't want a medical exam or wants an answer sooner rather than later.

Some of the factors Sproutt will ask you about before setting a rate include:

- Movement

- Sleep

- Emotional health

- Nutrition

- Balance

Here are the six types of life insurance policies that Sproutt offers.

Policy Type

The rates for women age 58 include:

- $95.90 a month on average

The rates for men age 58 include:

- $122.25 a month on average

These rates will vary depending on whether or not you smoke as well as the five factors mentioned earlier.

SelectQuote

SelectQuote isn't an insurance company. Instead, it helps you shop around for an insurance policy by getting quotes from a wide variety of carriers.

The companies SelectQuote shops for quotes from include:

- Americo

- Banner

- Lincoln National

- William Penn

- United of Omaha

- Pacific Life

- Protective

- Prudential

- AIG

- Companion

- SBLI

- Global Life

- TruStage

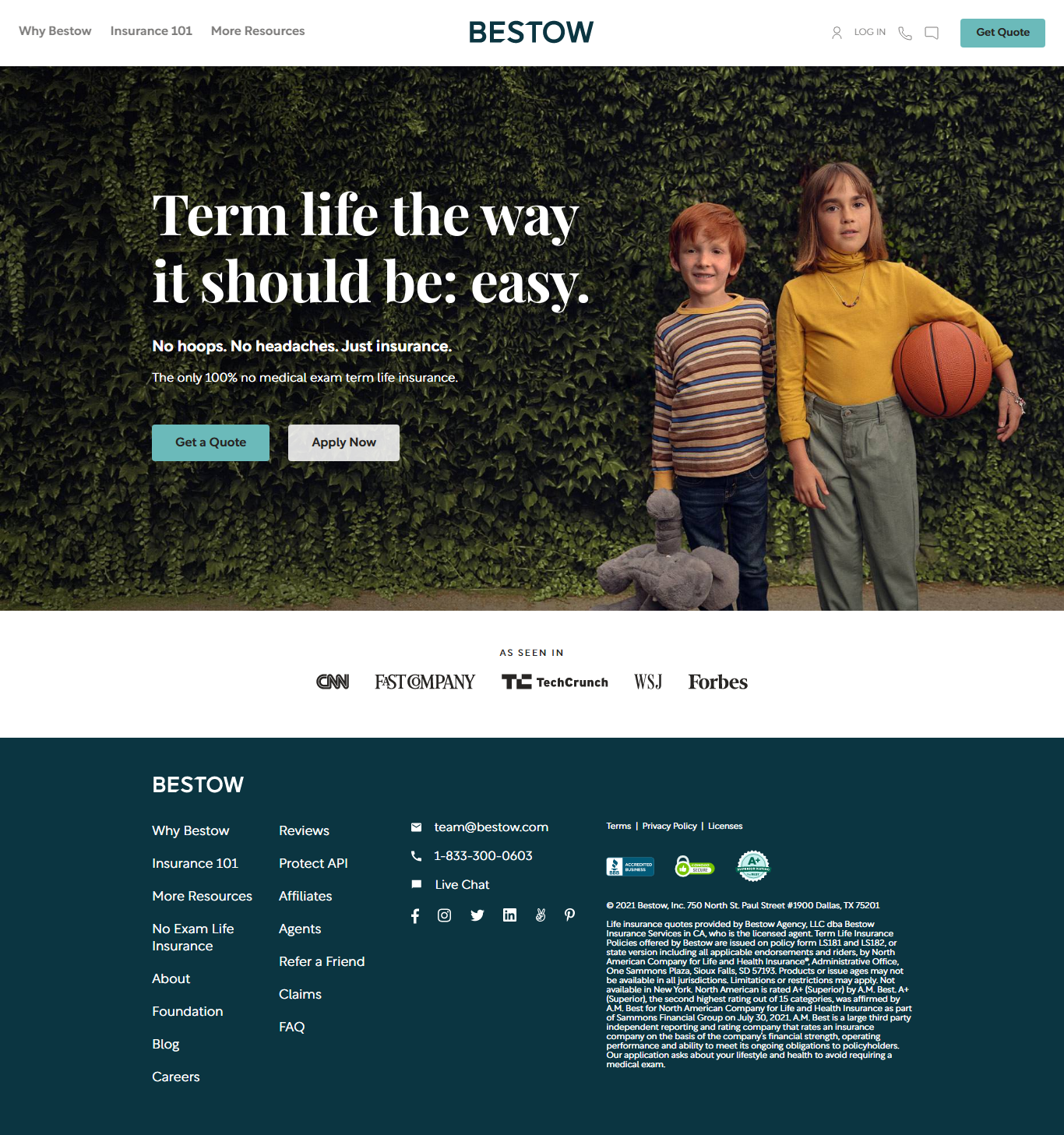

Bestow

Bestow is another great option if you're in a hurry or prefer not to go through a medical exam. Even better is the fact that you know almost immediately if Bestow is willing to offer you a policy.

It's important to note that Bestow won't insure anyone past the age of 60, so if you want a life insurance policy with them, you need to act as soon as possible. The good news is that your coverage won't end when you turn 60. It lasts for 10 years, so if you sign up now, your policy will last until you're 68.

Before applying with Bestow, you should be aware that it won't offer coverage to anyone who has been diagnosed with cancer in the past 10 years. If you have, then it's better to skip Bestow, and check out another insurance carrier.

The max coverage rate is up to $1.5 million.

Average premiums for 58-Year-Olds:

| Term | Coverage | Cost |

| 15-Year | $500K | The policy cost range from $53.40/month for a non-smoker female |

| 15-Year | $500K | The rates range from $73.20/month for a non-smoker male |

Progressive

Progressive is one of the more well-known companies out there and has a solid rating to back its reputation. It's a great option if you want to bundle your life, home, and auto insurance into one bill. It offers life insurance coverage to anyone up to age 80, so you don't have to feel like you're in a rush when you sign up with Progressive.

With Progressive, you can get the following policy types:

- Term

- Final Expense

- Whole

- Universal

- Variable

Liberty Mutual

Liberty Mutual is another company that is well known, thanks in large part to some of its commercials. Approval is typically fast, so you'll know promptly if you need to move on.

Liberty offers the following policies:

- Term life

- Whole

- Fixed annuities/fixed incomes

Women age 58 will pay $70.52 for a $100,000 policy/10 years. Men age 58 will pay $118.76 for a $100,000/10-year term policy.

State Farm

State Farm offers Term Life, Whole Life, and Universal Life insurance. It can be much pricier than other insurance carriers.

For example, a 58-yr-old woman will pay $173.99 for a $500,000 policy for a 20-year policy. A 58-yr-old Men will pay $259.24 for the same.

Banner Life Insurance Company

Banner Life Insurance company is owned by Legal & General America and is the seventh-largest insurer in the world. It's been in business for over 70 years now, and is very experienced when it comes to life insurance.

Banner Life Insurance offers two different policy types:

- Term Life

- Universal

Typical Average Premiums in Some States for 58-year-olds

Since premiums vary by your gender, age, and what state you live in, it’s good to have an idea of the cost when you’re 58 years old and looking for affordable life insurance providers.

People at age 58 can expect:

| State | 10-Year Term - $500K Coverage |

| California | Average Life Insurance Cost of $79/month females and $105/month males |

| Texas | Average Cost of a Life Insurance Policy is $77/month females and $108/month males |

| Florida | Average Life Insurance monthly premium for a 58 yr old is $79 a female and $107 a male |

| New York | Average premium of a Life Insurance is $79 per month for females and $107 per month for males |

| Pennsylvania | Average Life Insurance premium is $75/month females and $105/month males |

| Kentucky | Average Life Insurance monthly rate is $76 a female and $106 a male |

| Ohio | Average rate of a Life Insurance policy is $74 per month for females and $105 per month for males |

These are not all the insurance companies out there, and the rates quoted to you may be different once the company offers you a policy. It's a great place to get started, however, and will give you a better idea of how to proceed when you decide to go shopping. If you still feel that you would like to check for more options, you can easily compare companies and find the one that better meets your needs and budget by clicking below.

Cheap Life Insurance Quotes by Age

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.

![Can You Get Life Insurance for Your Parents? [Complete Guide]](/assets/images/4195a596c9c2e2afdae7712685f340fc.png)