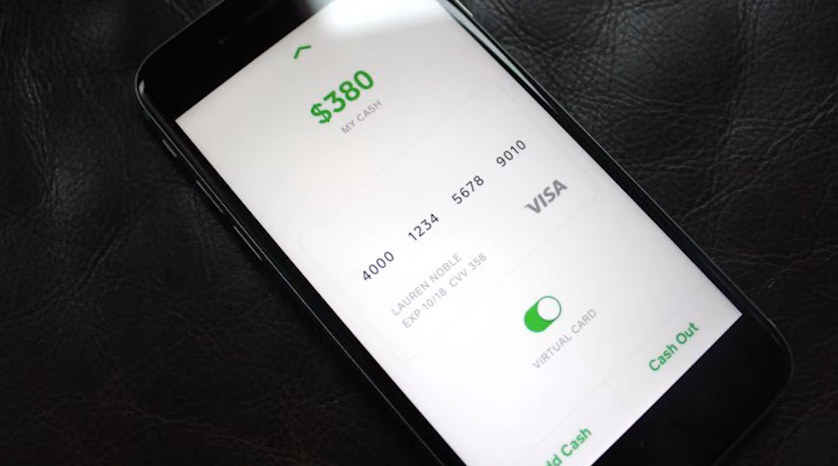

Cash App is a peer-to-peer or “P2P” financial app that makes it easy to instantly send money to both friends and businesses alike. Formally known as Square Cash, it was founded back in 2013 by Jack Dorsey’s Block Inc. to compete with similar services like PayPal and Venmo.

What We'll Cover

- What Cards Can You Use with Cash App and How?

- How to Connect Debit Cards to Cash App?

- How to Connect Credit Cards to Cash app?

- Top Credit Cards Supported on Cash App

- Prepaid Cards that Work with Cash App

- Secured Credit Cards That Work With Cash App

- Online/Virtual Banking Cards That Work With Cash App

- What Cards Are Not Supported by Cash App?

- How to Make Physical and Direct Deposits to Cash App

- How to Add Money to Cash App at A Physical location

- Enabling Direct Deposit on Cash App

- Linking a Bank Account to Cash App

- The Bottom Line On Cards That Work With Cash app

Each Cash App user chooses a unique user name called a $Cashtag that’s identified with their account. In order to pay or request money from another user, you can search for them by either their $Cashtag, name, email address, or phone number.

Over the years, Cash App has also developed a number of other great features that make it a one-stop-shop for all your financial needs. Users can also get a fee-free debit card that works sort of like a Cash App prepaid card by allowing you to spend money in your account. Cash App users can also invest in stocks and cryptocurrency, or even file their taxes right from the app.

You May Also Want To Read:

- The 9 Best Reloadable Prepaid Cards With No Fees

- Here's How to Transfer Money From Prepaid Cards to Bank Account

What Cards Can You Use with Cash App and How?

Generally speaking, Cash app works with Credit and Debit Cards from Visa, MasterCard, American Express, and Discover. However, you may wonder if are there other types of cards that you can use with cash app, so we made a top pick that includes many options for you to use with your cash app account and how you can link them to it

One of the more convenient ways to fund your Cash App account is by connecting it to your existing debit and credit cards. Here’s how to get started:

How to Connect Debit Cards to Cash App?

Connecting Cash App to your other debit cards couldn’t be easier and is a nice option that allows you to transfer money between the two. Once you add a debit card to your Cash App account, you can also use it as a payment option when sending money to others.

To link a new debit card, just tap on the “Account” icon at the top of the app and then the “Linked Banks” option. You can then link your bank account by entering your debit card number, expiration date, and CCV.

How to Connect Credit Cards to Cash app?

Once you’ve linked a debit card to your Cash App account, an option will appear under "Linked Banks" that also allows you to link credit cards to your account. This works in much the same way as linking your debit card. You’ll simply enter your card number and verification info.

Once your cards are connected to your virtual wallet, you can also use them as a payment option to send money to other users. Just keep in mind that if you do use a credit card as a payment option, Cash App charges a 3% fee. If you're in the market for a new credit card to add to your Cash App account, then check out some of these top offers:

Top Credit Cards Supported on Cash App

Upgrade Cash Rewards Visa®

- 1.5% unlimited cash back on card purchases

- No annual fee, activation fee, or maintenance fees

- Mobile app access

- Built-in contactless payment option

- Fair to excellent credit required

Petal® 2 "Cash Back, No Fees" Visa® Credit Card

- No fees whatsoever

- 1% - 1.5% cash back on elegible purchases, 2% - 10% bonus cash back at select merchants

- $300 - $10,000 limits

- Designed to help build credit

- No intro APR

- Rewards can get a bit complicated

Prepaid Cards that Work with Cash App

According to Cash App support, the platform works with both debit and credit cards. But what about prepaid debit cards?

Cash App is a bit vague about this, but does say that they support most prepaid cards. While you can use prepaid cards as a payment method, however, you cannot currently use Cash App to deposit funds onto them from your Cash App account.

It's also important to understand what Cash App is referring to when they say "prepaid cards." The type of prepaid cards that work with Cash App are not cash gift cards, but prepaid debit cards, such as the following:

Netspend® Visa® Prepaid Card

- No late fees or interest rates

- No credit check or bank account needed

- Get paid faster with direct deposit

- Cash back rewards options

- No minimum balance

- Variable monthly maintenance fee of up to $9.95

- ATM, purchase, and inactivity fees can add up quickly

Brink's Money Prepaid Mastercard®

- No later fees or interest rates

- Direct deposit, mobile check upload, and account alerts are available

- Customizable card

- Payback points

- Monthly service fees of up to $9.95/month

- An extensive list of fees can get expensive quickly

Secured Credit Cards That Work With Cash App

Secured credit cards may be a nice alternative to the Cash App prepaid card option for users looking to boost their credit report. The good news is that you can usually get a secured credit card even if you have a less than stellar credit history. Keeping your balance on the lower end and making your monthly payments on time every month can go a long way towards improving your credit score.

Otherwise, secured credit cards work in much the same way as regular credit cards, so using them with Cash App shouldn't be an issue. If this sounds like a solid option for you, then here are some of the top secured credit cards we recommend:

OpenSky® Secured Visa® Credit Card

- No credit check required

- Your refundable deposit becomes your new credit line, starting as low as $200

- Reports to all 3 major credit bureaus to help build credit quickly

- 17.39% variable APR is on the lower end for cards of this type

- $35 annual fee

PREMIER Bankcard® Secured Credit Card

- No checking account required

- Great for those with poor or no credit

- Reports to Consumer Reporting Agencies monthly to help rebuild credit

- No monthly fee

- $50 annual fee

- $200 refundable deposit is required to open an account

Online/Virtual Banking Cards That Work With Cash App

These days, online banks offer the same perks as traditional banks, often with lower fees. Check out these options that come with debit cards that you can add to your CashApp wallet.

Ally Bank Debit Mastercard®

- No overdraft, maintenance, or low balance fees

- Remote Check deposits

- 0.25% internet yield

- Round-ups to connected savings account available

- Large fee-free ATM network

- No physical locations

- No cash deposits

Chime Visa® Debit Card

- No monthly fees, late fees, or minimum balances

- Fee-free overdraft up to $200

- Get paid up to 2 days early with direct deposit

- 24/7 live support

- Sign up online in minutes

- No physical locations

- No cash deposits

You may also like: Chime Bank Review 2023: Is It Right for You?

What Cards Are Not Supported by Cash App?

Unfortunately, gift cards are not currently supported by Cash App, even cash cards from major suppliers like Visa or Mastercard. There are a few government-enabled prepaid cards that work with Cash App, though the platform is pretty vague about specifying exactly which ones.

Additionally, Cash App does not currently support ATM cards, business credit cards, or PayPal cards.

If this is a deal-breaker for you, then you may want to head over to PayPal or Venmo instead, both of which do support prepaid gift cards backed by Visa, Mastercard, American Express, and Discover. The only exception is that prepaid gift cards cannot be used to pay for recurring services, such as subscriptions.

How to Make Physical and Direct Deposits to Cash App

Before you can enjoy all the benefits that Cash App has to offer, you’ll need to create and fund an account. Let’s check out the various ways that you can (and can’t) add funds to your Cash App balance.

How to Add Money to Cash App at A Physical location

While Cash App doesn’t have physical locations of its own, it does have plenty of partners that can handle in-person deposits for a $1 fee. Just tap the “Paper Money” option and the app will show you a list of nearby locations where you can deposit money by showing the cashier a code the app will generate for you.

Enabling Direct Deposit on Cash App

Cash App’s banking features allow a direct deposit option that can help you get your paychecks up to two days faster. In order to use this option, you’ll need to order your free Cash App Visa Cash Card, which you can do by visiting the “Direct Deposit” tab or clicking the Cash Card icon at the bottom of your account.

Linking a Bank Account to Cash App

One of the easiest ways to link Cash App to your bank account is to link your debit card, as we mentioned before. But if you want to link Cash App directly to your bank account, you can do that also. Navigate to the “Linked Banks” tab, select your bank from the list, and follow the prompts to use your online banking login to verify your new account.

The Bottom Line On Cards That Work With Cash app

Overall, there are a great selection of debit, credit, virtual, and prepaid cards that work with Cash App. The platform also offers a free debit card that you can connect to your account, which is a lot like having a Cash App prepaid card but without any fees. Hopefully this has helped give you an overview of what Cash App is and how it works!

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.

How to get some of the cards

Do you have a card called VanillaSky?

Does cash app work with Direct Express

What about Rapid pay card?

Very thorough and informative! I'm in!