According to the National Association of Realtors, close to one-quarter of all home buyers have student loan debt, and 37 percent of first-time home buyers have student loan debt. Buying a house with student loans may have some challenges, but this debt should not prevent you from qualifying for a home loan.

What We'll Cover

- Can I buy a home with student loan debt?

- How much do student loans affect the purchase of a home?

- Does having student loans affect credit scores?

- How are student loans calculated when applying for a mortgage?

- How does Freddie Mac calculate student loans?

- FHA mortgage guidelines for student loans

- VA mortgage guidelines for student loans

- USDA mortgage guidelines for student loans

- What happens if I am close to paying off my student loans?

- How do you calculate DTI with student loans?

- Tips for Buying a Home with Student Loans

Learn more about the different strategies for buying a home when you have student loans:

Can I buy a home with student loan debt?

It is possible to purchase a home when you have student loan debt. However, it may be more challenging to get approved. Paying off the debt or refinancing it at a lower monthly payment can help increase your chances of getting approved.

When a mortgage company looks at an applicant for a new home loan, they consider various financial factors, including debt obligations, employment history, and credit score. Though student loans are factored into your credit obligations and score, mortgage underwriters do not disqualify applicants solely because they have student loans. Underwriters consider your overall financial health to determine if you can pay the monthly mortgage payments, with or without student loans.

Additionally, student loan payments may make saving the money needed for the down payment more challenging. Depending upon the type of mortgage you apply for, you will need anywhere from 3.5 percent to 20 percent of the price as a down payment. Additionally, you could need an additional two to five percent of the loan for closing costs and other home-buying costs.

Ultimately, if you have a steady job, pay your bills on time, and have an emergency fund, you might be in a good position to get approved for a home loan. Before applying for a home loan, look over your finances, budget, and savings to make sure you can afford your monthly student loan and mortgage payments.

How much do student loans affect the purchase of a home?

Student loans can impact your debt-to-income ratio (DTI). Lenders use your DTI to evaluate your buying power and determine how much of a home loan you can afford. The more debt you have, the higher your DTI is, which can result in a lower credit score. In addition to your DTI, your credit score is used to assess the risk associated with giving you a home loan.

Having student loans can impact your DTI and credit score in many ways, which could affect your purchase of a home. The higher your monthly student loan payments are, the higher your DTI, which leaves less money for your monthly mortgage payment. Many lenders require a DTI of 36 percent or less, and your student loans may put you above this percentage.

Additionally, if you have had trouble paying for your student loans, you may have a low credit score due to late payments. A lower credit score could negatively affect your chances of getting approved for a home loan. On the other hand, on-time monthly student loan payments could improve your score and demonstrate your creditworthiness.

Your credit report may also improve by having a good mix of credit types, such as loans, revolving credit, etc.

Does having student loans affect credit scores?

Having student loans does affect your credit score. Student loans can have a positive or a negative impact because it is calculated based on your overall payment history, DTI, and amount of credit borrowed.

Since your credit score includes the amount you owe on loans, length of credit history, payment history, and mix of credit types, you can use your student loans to build your credit while maintaining a good score. Establishing good credit can help improve your chances of qualifying for a lower-interest home loan.

However, if you cannot make your student loan payments on time, the missed or late payments could lower your score, reducing your chances of getting approved for a home loan.

If you are having trouble managing student loan payments, speak with your servicer to learn more about the options available to reduce or temporarily stop them.

How are student loans calculated when applying for a mortgage?

The different home loan options calculate student loans differently. We have included the various types of home loans and how they calculate student loans below:

How does Freddie Mac calculate student loans?

Freddie Mac calculates your monthly student loan payment into your DTI. However, if your student loan is in forbearance, deferred, or the monthly payment is $0, the lender can only factor 0.5 percent of your student loan balance into your DTI.

FHA mortgage guidelines for student loans

When applying for an FHA mortgage, your student loans are calculated based on your monthly debt obligations. The payment amount used for your student loan debt is obtained from your credit report or recent student loan statement.

FHA lenders prefer borrowers with a 43 percent or lower DTI but have approved applicants with a higher DTI when they have high credit scores and emergency cash reserves.

If your loan is in forbearance, deferred, or you have an income-driven repayment plan, only 0.5 percent of the remaining student loan balance is calculated in your DTI.

VA mortgage guidelines for student loans

Active military members, veterans, or surviving spouses may qualify for a VA loan to purchase a home. The required DTI for a VA loan is 41 percent or less. If you have student loans and have been making payments or expect to start making payments within 12 months of buying a home, your monthly student loan payment is calculated with your DTI.

However, if you are not making student loan payments and do not expect to make payments within the 12 months following the purchase of your home, your student loans are not calculated as part of your DTI.

USDA mortgage guidelines for student loans

Lenders look for a DTI of 41 percent or less when applying for a USDA loan, but depending upon the circumstances, they may allow for a higher DTI. The full amount of your monthly student loan payments is used to calculate your DTI. If your loans are deferred, in forbearance, or part of an income-based repayment plan, only 0.5 percent of your student loan balance is calculated as part of your DTI.

What happens if I am close to paying off my student loans?

If you are within ten months or less of paying off your student loans, lenders may opt not to include your monthly loan payments in your DTI. In most cases, this scenario is also actual when your student loans are expected to be fully forgiven.

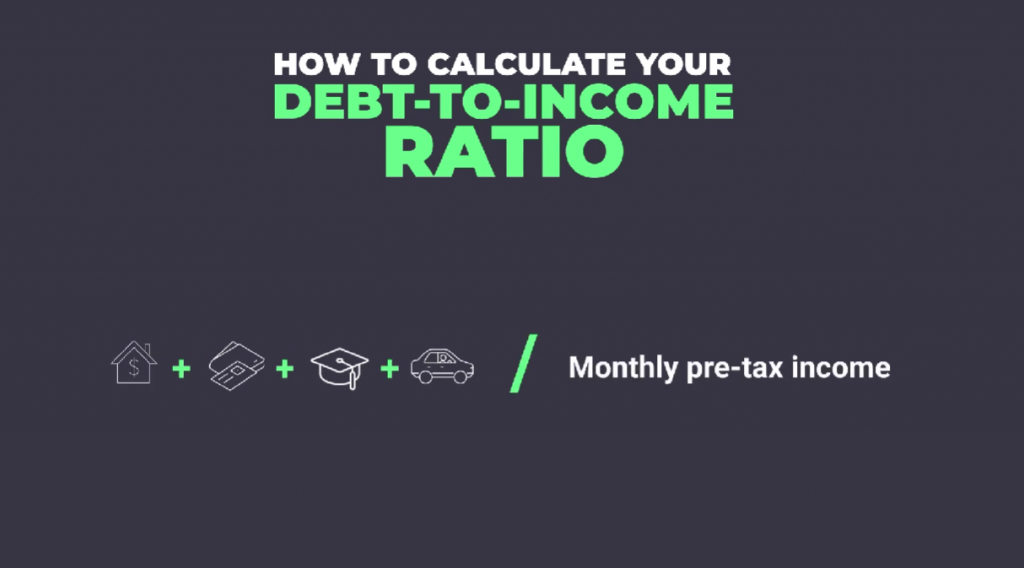

How do you calculate DTI with student loans?

DTI is calculated by dividing your debts paid monthly by your gross monthly income and multiplying it by 100 to get the percentage. For example, if your monthly student loan payments are $500, you have $200 in monthly credit card debt, and you have $300 in monthly personal loan payments, your total monthly debt is $1,000.

If your monthly gross income is $4,500, your total DTI is 22 percent.

Should I pay off my student loans before applying for a home loan?

Though you can get approved for a mortgage when you have student loans, paying off this debt first may be beneficial when applying for a home loan. Some benefits of paying off your student loans first include avoiding high student loan debt interest and lowering your DTI to increase how much home you can afford.

Tips for Buying a Home with Student Loans

If you have student loans, there are some things you can do to improve your chances of getting approved for a home loan. However, before applying for a student loan, it is imperative you check your finances to ensure you are not taking on more debt than you can afford. In addition to checking to see if you can afford a home with your student loans, you can do several other things to buy a house.

Improve your credit score

Home loan lenders first consider their credit score when reviewing an applicant's ability to qualify for a mortgage. Improving your personal credit score can help increase your chances of buying a home, even when you have student loan debt. Some of the things you can do to improve your credit score may include the following:

- Regularly check your credit report for errors

- Pay your bills on time

- Keep a low credit utilization

- Avoid closing an old account

- Have a good mix of credit types

Reduce your DTI

Reducing your overall debt-to-income ratio before applying for a home loan is best. If you cannot pay off your student loan debt, check your finances to see what other bills you can pay to help reduce your overall DTI. Smaller bills, such as credit card balances, personal loans, and car payments, may be more manageable to pay off than your student loan and can significantly impact your DTI.

Another way to reduce your DTI is to increase your income by getting a second job, asking for a raise, or working a side gig.

Apply for a preapproval

Speak with a home loan lender about getting preapproved to see your buying power. If you are not approved for the loan or do not qualify for enough money for the home you need/want, the lender may be able to give you advice on how to improve your approval chances when you are ready to purchase the home.

Look into down payment assistance programs

Having student loans can make saving money for a down payment on a home is challenging. Check with your lender to see if you can use any federal loan programs to help make the down payment for your new home.

Do not let student loans prevent you from buying a home. Take the necessary steps to improve your chances of getting approved for a home loan while still paying your student loan balance. It may be more challenging, but getting approved for a home loan is rewarding, especially when you receive the keys to your new home.

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.

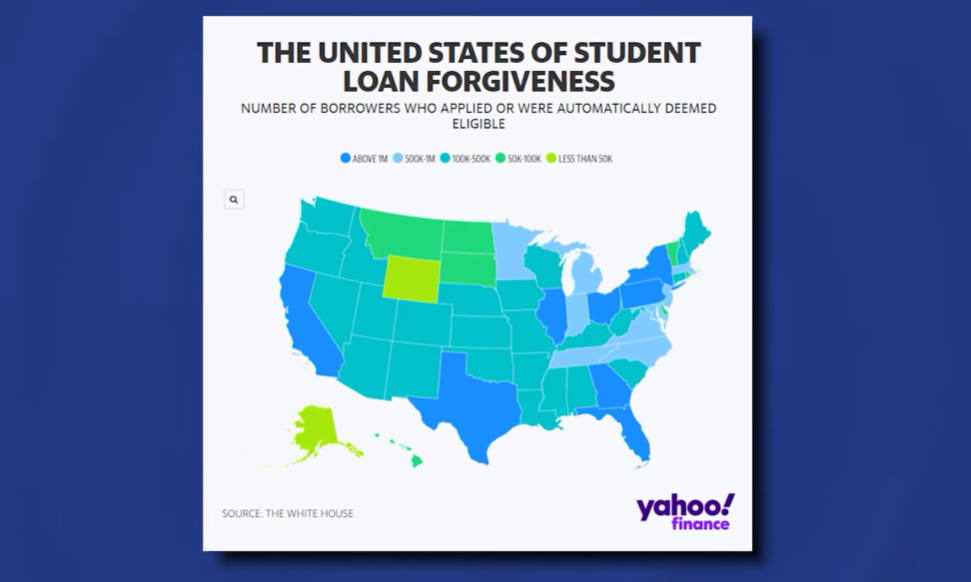

![Student Loan Relief & Forgiveness Programs by State [2023 Updates]](/assets/images/a7d15511dd5f23f8d39f4a65aaca256c.png)