Life insurance is essential for people with growing families who depend on their income for financial support. Although it becomes less of an issue as you age, you still have financial obligations after your children grow up. Besides, there will be final expenses, including medical and funeral costs after you die. For these reasons, purchasing life insurance is crucial irrespective of age. It’s especially important to look for the best cheap life insurance providers for those 56 years old so that you find the best plan and coverage.

What We'll Cover

At 56, you have plenty of options when purchasing life insurance, although it can be more challenging than younger people. It is possible to find affordable life insurance coverage, though, even if you have health issues. This guide provides great insight into finding the best coverage when you are 56 years old.

What to Look for in Cheap Life Insurance Providers for 56 years old

Choosing a suitable life coverage means attaining a balance between what you pay today and what you leave for your loved ones after your demise. While a monthly premium is a critical factor, there are other key considerations when choosing the right life insurance policy at 56.

Policy Type

When buying life insurance, you will choose between two broad types: term life and whole life insurance.

- Term Life Insurance: This policy type offers coverage within a specific period, usually 5, 10, 15, 20, 30, or 40 years. You pay a premium that will provide for your beneficiaries during this period should you die. If the period elapses before your demise and you fail to convert or renew your policy, you stop paying, and the contract gets terminated.

- Whole Life Insurance: This is considered an investment where you receive coverage from the first day you sign up until your death. Unlike term life, whole life insurance generates cash value, allowing you to cash out or take a loan against it after it matures.

Pricing

Life insurance policy prices vary depending on factors like policy type, insurer, and your unique circumstances. When shopping around for coverage, compare prices and consider providers that take into account elements such as your health, travel history, and other habits. Choosing a more in-depth policy ensures you get more tailored premiums, usually with discounts.

Affordability

Choosing cheap life insurance providers for those 56 years old is critical since the policy provides financial security for your loved ones after your death. However, it should not mean that you greatly impact your current financial situation to secure the future of your beneficiaries. Hence, consider a policy that fits your budget where you can afford your monthly premiums even when times get tough.

Option to Convert Policy

Most people in their 50s will consider purchasing a term life insurance policy because of their age. However, you will likely live beyond the term of your policy if you are in good health. Once you hit the final year of your term life policy, converting it into a permanent policy is essential.

Some life insurance providers lack the option to convert a term life policy into a permanent life policy. Choosing a life insurance policy with an opportunity to convert swiftly enables you to avoid going back to the market searching for a suitable life insurance provider after you are 56 years old.

Living Benefits

Finding a life insurance policy that offers certain benefits while still living can be critical because it enables you to take premiums paid to cover medical expenses, cancer treatment, and more. Although taking funds from your policy lessens the benefits to your beneficiaries, it saves you and your loved ones from financial turmoil if you fall sick or become incapacitated.

Top 7 Cheap Life Insurance Providers For 56 Years Old

Mutual of Omaha

Founded in 1909, Mutual of Omaha boasts a sturdy portfolio of insurance solutions, mainly term life and permanent life insurance. In addition, the provider offers streamlined underwriting processes and competitive monthly premiums.

In addition, the company has excellent customer satisfaction, making it a perfect option for 56-year-olds. Among the top benefits of considering Mutual of Omaha is that the company offers the Mutual Perks program with savings on mortgages, wellness services, and travel.

Mutual of Omaha offers life insurance from $100,000 for a term of 10, 15, 20, or 30 years. There is an option to renew or convert the policy to permanent coverage. At 56, you can pay about $100 per month for a 20-year policy with $250,000 of coverage.

Pros:

- Multiple policy options

- Competitive rates

- Exceptional customer service

- Online quotes and purchases

Protective Life

Protective Life is the best budget life insurance provider offering low-cost premiums and a unique Custom Choice Policy, an alternative plan to term life insurance at a lower cost. What’s more, the company provides an option to reconsider an individual's rate after one year of the policy in the event of health or circumstances change.

You can purchase a policy of between $100,000 and $50,000,000 from Protective Life for a term of 10-40 years.

For example, a male aged 56 purchasing a $250,000 policy can pay $116 per month for a 20-year term while a female aged 56 can pay around $103 per month.

Pros:

- Competitive rates

- Online applications

- Rate readjustment after a year

- Higher life insurance coverage

Fidelity

Fidelity Life offers incredible coverage options for 56-year-old males and females with no invasive medical exams. With RAPIDecision policies, Fidelity provides coverage from the application date, making it a top no-waiting periods company. In addition, you can purchase up to $1,000,000 coverage with RAPIDecision Life term coverage for 10, 15, 20, or 30 years.

Customers can choose from a range of coverage options, including term life, whole life, and permanent life insurance when purchasing.

For example, for a 56-year-old male, you can pay around $160 per month for a $250,000 cover for 20 years, while a 56-year-old female pays $111.

Pros:

- No medical exam required

- No waiting period

- Online quotes

- Multiple coverage options

- Competitive rates

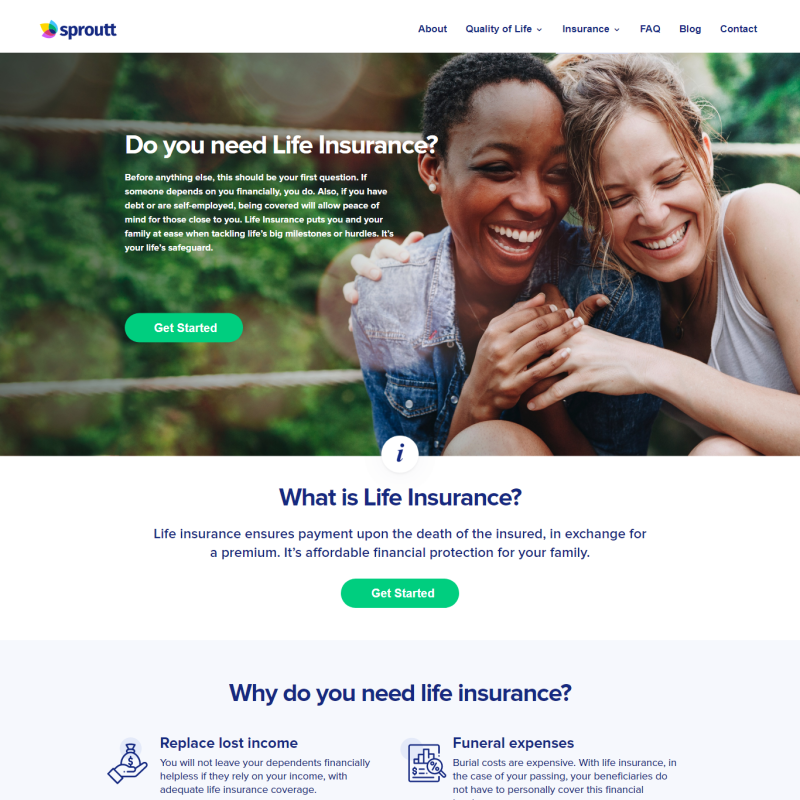

Sproutt

Sproutt is a fast-growing life insurance platform, leveraging Insurtech to provide Sproutt Instant approval life insurance. It is considered an insurance generator with multiple life insurance policies, including term life, permanent life, and no-exam life insurance. For 56 years old, Sproutt enables you to get an idea of possible cheap life insurance providers’ monthly premiums that you are likely to pay for life insurance. For life insurance policies, Sproutt lets you access up to a $1,500,000 policy for a term of 10, 15, 20, or 30 years.

Pros:

- No medical exam required

- Competitive rates

- Swift online quotes

- Great user experience

- Diverse policy options

- AI-based software

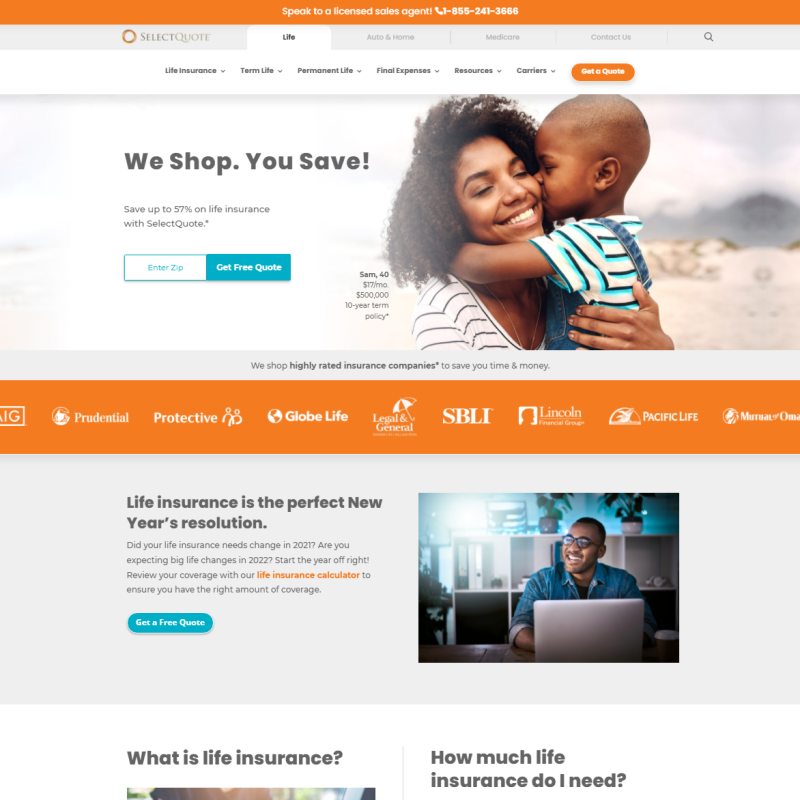

SelectQuote

SelectQuote is an online insurance sales company offering quote comparisons between top life insurance companies. With coverage of as low as $5,000 to a maximum of $5,000,000, SelectQuote lets 56-year-olds evaluate different insurers and buy a policy that best suits them.

To deliver accurate and reliable quotes, SelectQuote partners with various insurance providers, including:

- Prudential

- Americo

- Protective Life

- William Penn

- Pacific Life

- Banner Life

- AIG

- TruStage

- Companion Life

- SBLI

- Lincoln Financial Group

- United of Omaha

Pros:

- Competitive rates

- High life insurance policy amounts

- Access to the best cheap life insurance providers for those 56 years old

- Convertible term life policies

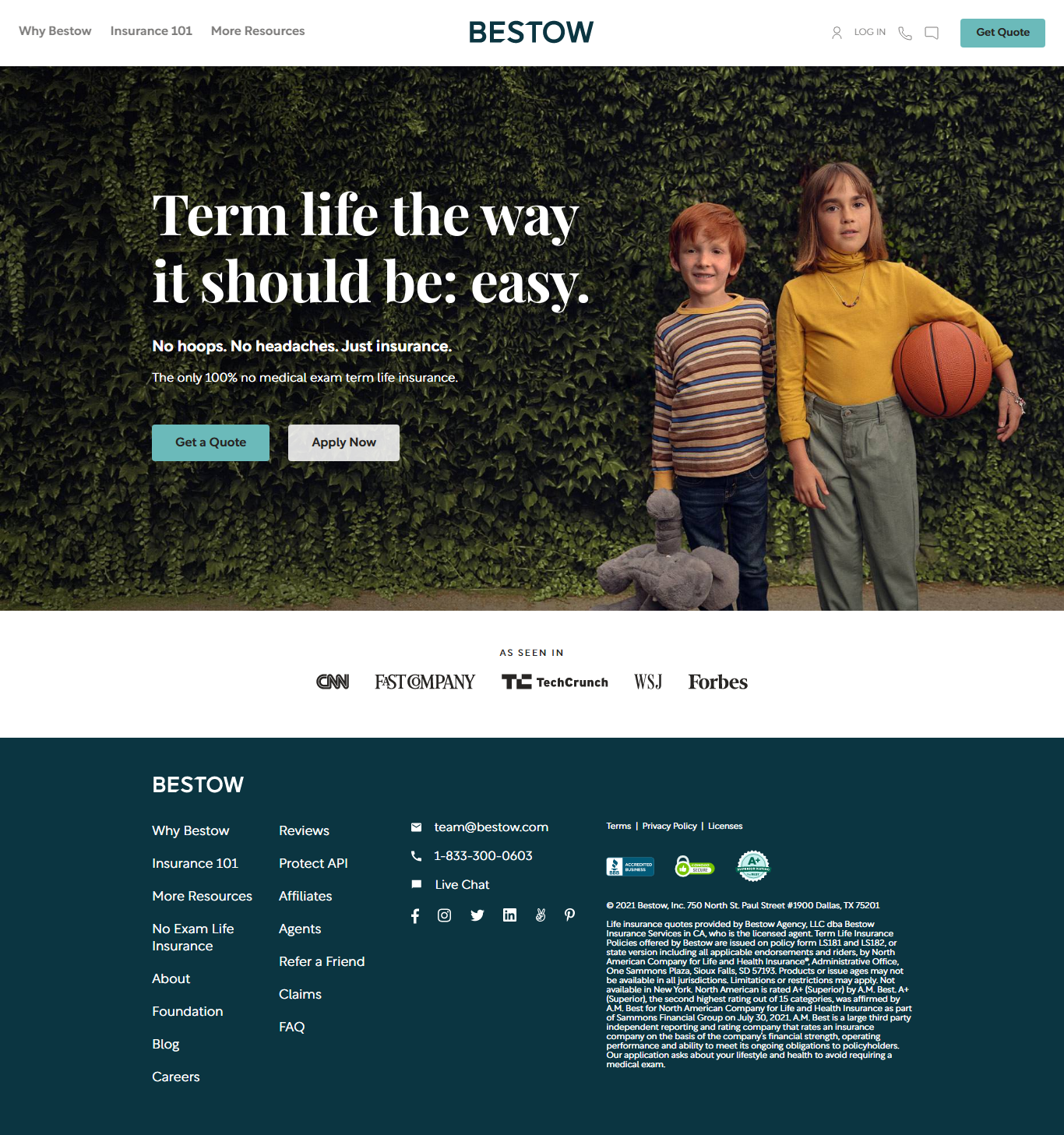

Bestow

Bestow is an Insurtech company that provides term life insurance online, leveraging customer data and algorithms to determine if a customer qualifies for coverage. At 56 years old, buying a life insurance policy from Bestow allows you to choose up to $1,000,000 for a term lasting 10, 15, 20, 25, or 30 years. The company also offers specialized instant life insurance, meaning applicants can get covered immediately without a medical exam.

For a 56-year-old male buying a $250,000 policy for a 20-year term, you can pay a $120 monthly premium while a 56-year-old female pays about $106 per month.

Pros:

- Good reputation from customers

- Wide range of term lengths

- Competitive rates

- Swift coverage

- No medical exam required

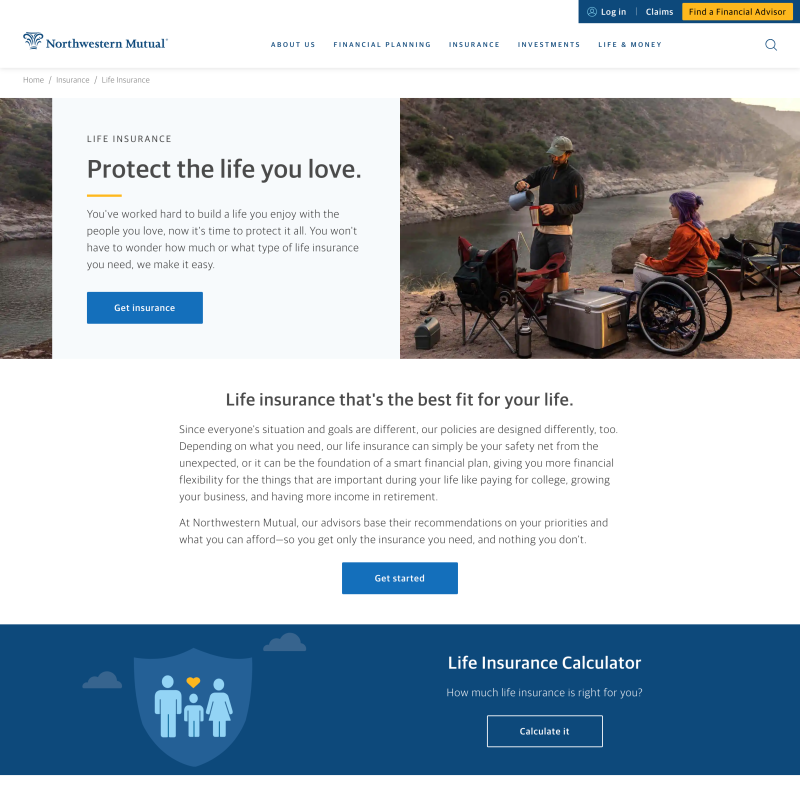

Northwestern Mutual

Northwestern Mutual has striking industry rankings, with the highest rating of A++ from AM Best and an A+ from the Better Business Bureau. Since companies that offer life insurance must be financially stable, Northwestern Mutual meets these requirements besides offering competitive coverage and good client feedback.

Term life policies have multiple premium levels with coverage starting from $100,000. The company also offers a Whole Life Plus option that combines term life and whole life policies. The coverage begins from $50,000, and it is available for customers up to age 85.

Other policies available include universal life offering a minimum coverage of $50,000 for a Single Premium policy and a Custom Universal Life Accumulator policy starting at $500,000 cover.

Pros:

- Variety of coverage types

- Combines term and permanent policies

- Some policyholders can receive dividends

- Financial stable

- High scores in industry ratings

Average Life Insurance Premiums by State for 56-yr-olds

for A 20-year Term With $500,000 Coverage

- California: $122 for males and $92 for females

- Texas: $162 for males and $113 for females

- Florida: $171 for males and $117 for females

- New York: $165 for males and $119 for females

- Pennsylvania: $156 for males and $112 for females

- Kentucky: $161 for males and $121 for females

- Ohio: $151 for males and $109 for females

Bottom Line for Cheap Life Insurance Providers for People 56 Years Old

If you are 56 years old, buying life insurance eliminates the need to worry about financial dependencies, final expenses, and debts after your demise. Above are some top cheap life insurance providers for people 56 years old including an extensive range of policies, solutions for those who need to buy coverage without a medical exam, and competitive rates. However, the best way to find the best rate is to compare prices from different providers by clicking here.

Cheap Life Insurance Quotes by Age

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.

![Can You Get Life Insurance for Your Parents? [Complete Guide]](/assets/images/4195a596c9c2e2afdae7712685f340fc.png)