Ohio is one of the most beautiful and dynamic states in the United States, with large urban cities, charming small towns, and verdant farmland spanning hundreds of miles. Despite its beauty, living in Ohio has its risks, and homeowners should always prepare for potential damage to their property. Ohio's temperate climate and northern location leave it prone to severe storms, tornadoes, flooding, extreme winter cold, snowstorms, landslides, and power outages. Wildfires have also become more common in recent years, especially in the southwestern part of the state.

What We'll Cover

The difficulties faced by many Ohio homeowners are not limited to natural disasters. According to the FBI, a total of 212,550 property crimes were reported in Ohio in 2017, with the majority of those crimes committed in the major cities of Columbus, Cleveland, and Cincinnati. However, Ohio's insurance premiums tend to be lower than many other states because there are no earthquakes. The risk of tropical storms is also significantly lower than other areas of the country. Although the premiums are lower, there is still risk of natural disasters and the potential for property crime damage, so it is more important than ever to have reliable and affordable homeowners insurance in Ohio.

Cheapest Ohio Home Insurance Providers

Whether you're a new homeowner or have owned your home for years, finding cheap home insurance in Ohio can seem overwhelming. In fact, according to Zillow, home insurance premiums average $35 per month for every $100,000 of property value, which can add up to a large portion of your monthly spending. To ensure that you are getting the best coverage at the right price, be sure to use a price comparison service to compare policies and costs from different providers.

There is no lack of insurance carriers in Ohio. In fact, Ohio is replete with insurance providers who offer affordable premiums, but this can make choosing your home policy a daunting task. Don't believe the ads - no single company offers the cheapest insurance for everyone. Every policy is different, based on your priorities and certain industry metrics, including:

- Age and condition of your home

- Size and geographic location of your home

- Proximity to the nearest fire station

- Amount of your mortgage

- Level of insurance coverage and deductible amount

- Your credit rating

- Prior insurance claims

To help you find the best provider for your home, we have compiled a list of the cheapest homeowner's insurance in Ohio. From local and regional providers to national carriers, we have found the lowest priced insurance policies that still offer quality coverage, so you can rest assured that you are getting the best coverage within your budget.

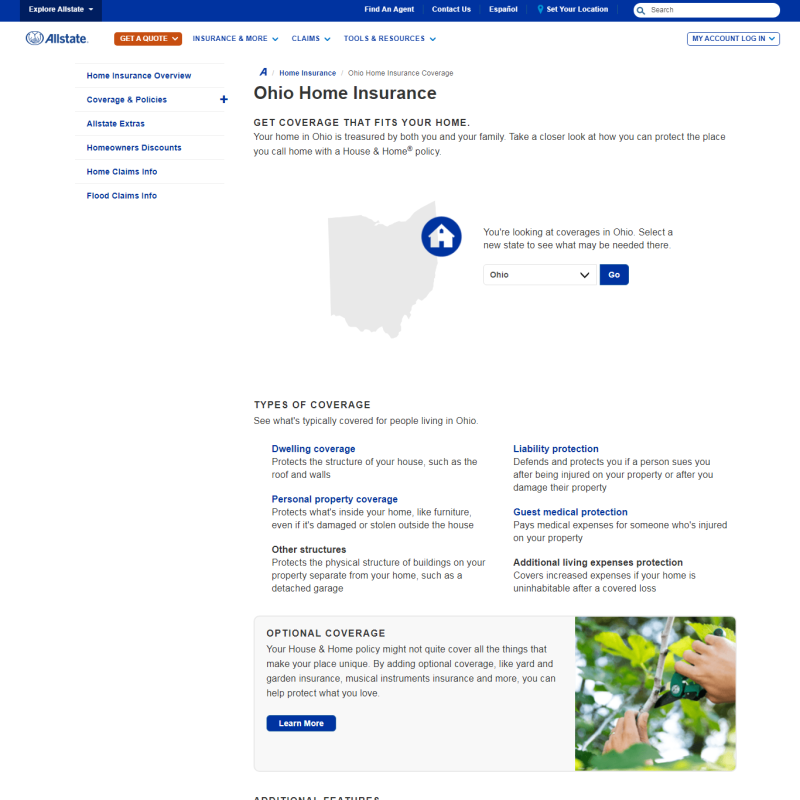

Allstate Insurance

Allstate Insurance is a well-renowned national insurance provider with local offices throughout Ohio. Although premiums may seem higher at first glance, all of the discounts that Allstate offers make it one of the cheapest homeowner insurance providers in Ohio. Allstate’s philosophy on home insurance is to “protect the place where memories are made.” Allstate understands that your home is not only your biggest asset—it’s also the foundation of your life and family.

Because of this, it’s important to pick the right insurance that will protect your home—and your money—in the event of an emergency, such as a natural disaster, a fire, or a robbery. To help you get started, local Allstate agents will meet with you to determine the best insurance policy for you. This all depends on several factors that the agents will walk you through. Because of this good customer service, you can be sure that you have the exact coverage you need. You'll find personalized service from a variety of local offices, where you can enjoy working with agents who are familiar with the particular needs of Ohio homeowners.

Once you and your agent settle on a policy, the agents will also help you get as many discounts as possible. This is a crucial step in the process. A helpful insurance provider understands the importance of saving money. After all, insurance is meant to protect your financial security. Allstate offers affordable coverage with numerous discounts, including early signer, new homebuyer, and hail-resistant roof discounts. In addition, you can also receive discounts for responsibly making your payments on time, bunding your Allstate homeowners insurance with your Allstate auto insurance, and switching to Allstate without having made a recent home insurance claim.

For customers who are heavily reliant on good technology, Allstate is the perfect match. The Allstate website is highly intuitive and allows you to select from an extensive array of coverage and deductible options. Allstate policyholders have access to an online portal that allows them to make payments online, as well as file and track claims. For convenience, there is an option to change the website language to Spanish, if that is your preferred language. Additionally, anybody can use the resources that Allstate offers, which include articles about insurance-related news, tips, and FAQ. To Allstate, having good insurance is only the first step. It’s also important to stay informed about how you can save money, protect your home and avoid high-risk factors. If you’re looking for a highly dependable insurance provider that offers discounts and good customer service, Allstate is a good place to start.

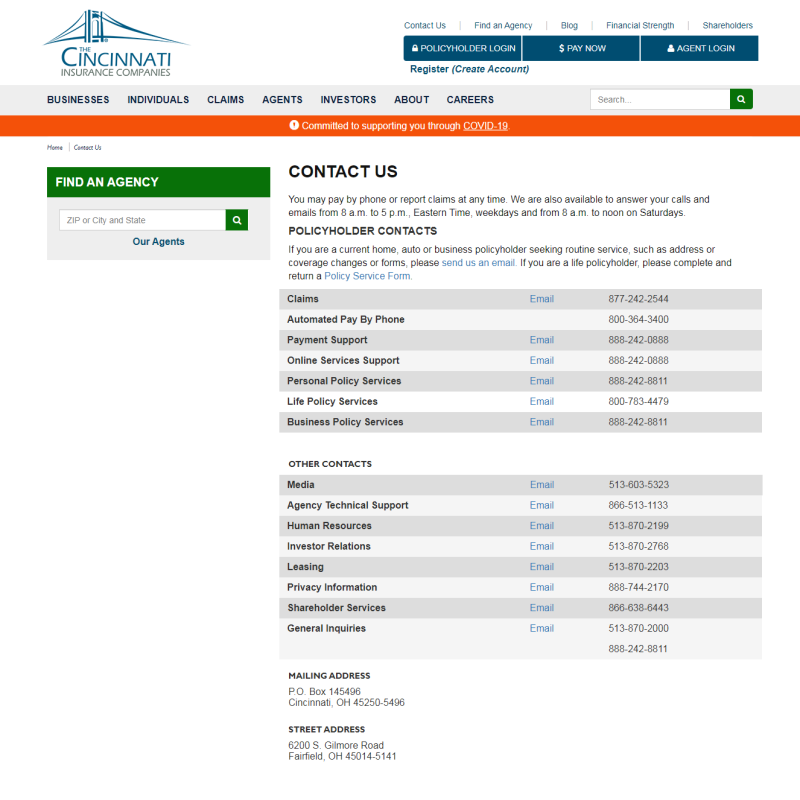

Cincinnati Insurance Company

The Ohio-based Cincinnati Insurance is a well-established local insurance provider that provides homeowners insurance at affordable prices, along with a variety of personalized coverage options. Although Cincinnati Insurance may seem more expensive than some other providers, it offers various benefits, such as a home alarm and bundled discounts. At Cincinnati Insurance, you are in the good hands of independent insurance agents that want to help you find the best policy. In addition to providing homeowners insurance, clients can also choose for condominiums and for tenants, which covers renters and their belongings.

The underwriters at Cincinnati Insurance Company are well-versed in the challenges of homeownership in Ohio. As a result, Cincinnati Insurance company offers an added Executive Homeowner Plus endorsement on its homeowners policies. This endorsement provides additional coverage for personal property and landscaping. You can even use the endorsement for replacement of spoiled food in the event of a natural disaster or power failure.

If you want a standard policy that covers the basics, Cincinnati Insurance provides several policies that customers can customize based on their needs. However, if customers want to add extra security to their insurance policy, they can do so by adding on optional coverage. For example, eligible customers can add coverage for earthquakes, damage to or by golf carts, and identity theft.

Additionally, Cincinnati Insurance provides numerous opportunities for customers to save money and reduce their premiums. When looking for homeowners insurance, it’s important to keep factors like these in mind. If you can save money as a new policyholder, there will also be opportunities to save money down the road. For starters, you can save money by bundling your auto insurance and homeowners insurance. Other ways to save money include owning a newer home that is less susceptible to risks, increasing your deductible, installing a home monitor or security system, and reporting no or few claims.

One unique coverage option that Cincinnati Insurance offers is its Personal Cyber Protection. Customers who are looking for coverage against cyber attacks should consider this coverage. The Personal Cyber Protection protects you from cyber attacks, cyber extortion, and online fraud that can occur on a computer, tablet, and smartphone. This is a great option to consider if you have a big family and tend to have many electronic devices at home. Cincinnati Insurance has a multitude of options for your needs. To get started, talk with an agent and find the best plan for you.

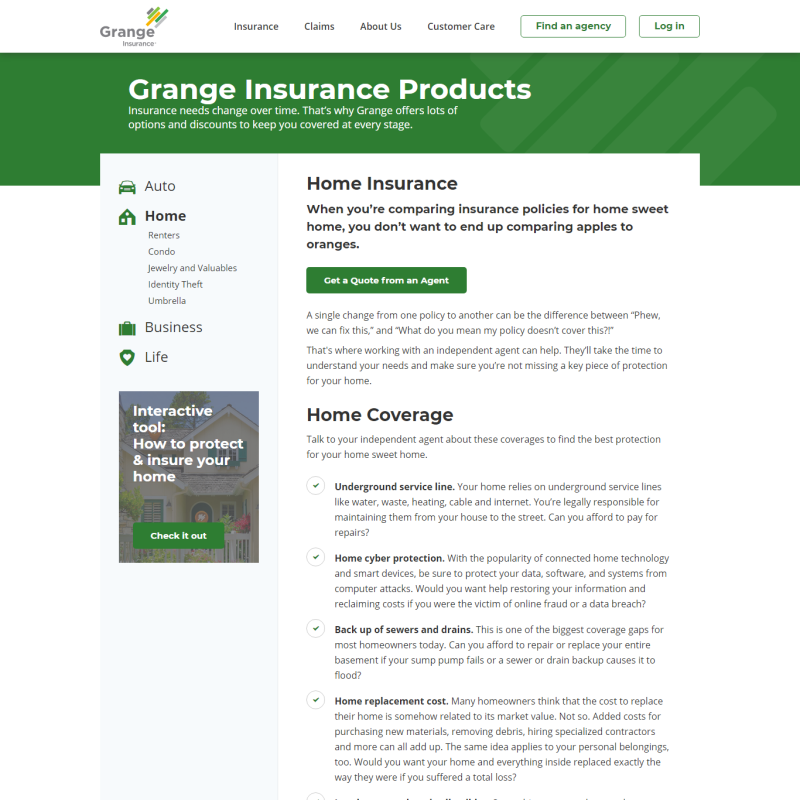

Grange Insurance

Another local favorite, Grange Insurance, is a small, well-established insurance company based out of Ohio. Grange Insurance has been providing insurance coverage for more than 80 years. Most importantly, it offers a personal touch that is not always available with larger insurance companies. Grange's customer service goes beyond the basics. Often, its employees go out of their way to provide comprehensive information so that their customers understand what they are getting. Grange offers reasonably priced coverage, along with discounts for home maintenance, claim-free, and smart fire alarms.

Many times, people forget that insurance providers offer protection against identity theft under homeowners insurance. Identity theft occurs when somebody uses your personal information to get a job, apply for loans, rent an apartment, and more. It’s important that you are actively protecting yourself from these activities. With Grange Insurance, you can get the protection you need. Grange Insurance partners with CyberScout, a company that provides security services, to help keep you protected. Policyholders with this coverage have access to resources to help prevent identity theft, as well as resources that will help you if you fall victim. Some of these resources and services include lawyer fees and communication with the government.

Furthermore, if you are a customer who has a lot of valuables in your home, Grange Insurance might be a good fit for you. One of Grange Insurance’s unique features is its option to insure valuables, collectibles, and jewelry. If you have priceless valuables that are irreplaceable, such as family heirlooms or wedding rings, this is a good option to consider. In fact, Grange Insurance states that claims jewelry loss are very common. To get started with this insurance coverage, a Grange Insurance agent will take you through each step. Throughout the process, you will also need to get an appraisal to determine the value of your high-value items. Items that customers can insure under this coverage include watches, paintings, and antiques.

Lastly, under homeowners insurance, Grange Insurance also offers umbrella coverage. Umbrella coverage is a great option for you if you want to be prepared for the worst situations. With umbrella insurance, you can receive extra coverage in the case that your homeowners insurance policy doesn’t cover all of the expenses that you need it to. Grange Insurance recommends that you consider umbrella coverage if you own a dog, have a trampoline or pool, have a long commute to work, and more. Umbrella coverage can cover legal expenses, as well as medical payments.

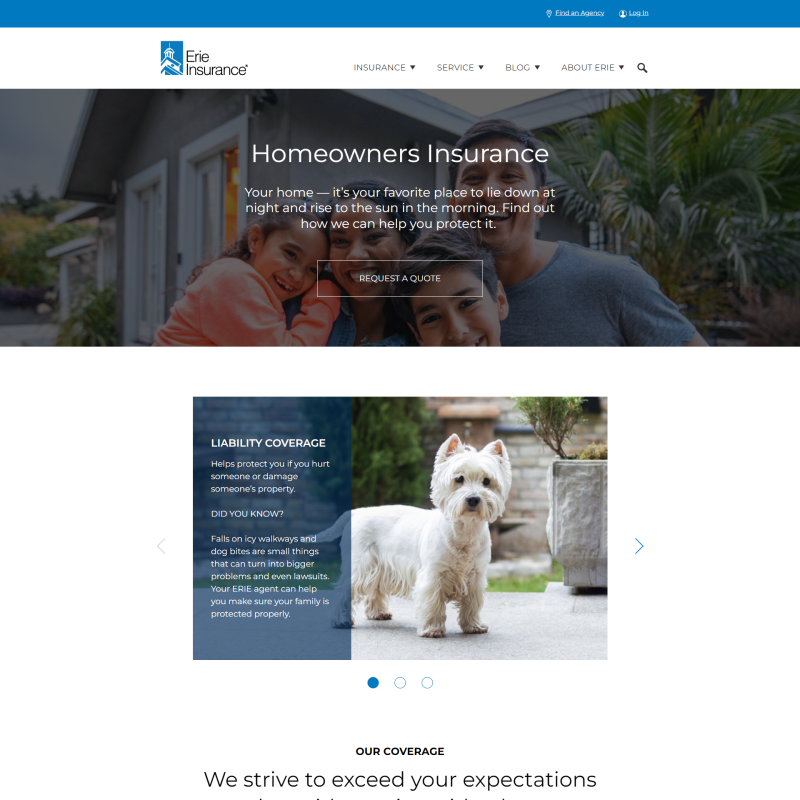

Erie Insurance

Based out of Pennsylvania, Erie Insurance ranks as one of the highest on our list for customer satisfaction. From its main Ohio office in Loveland, Erie Insurance provides affordable quotes for homeowners insurance that are typically much lower than national providers. As a regional insurance carrier, Erie Insurance is familiar with the particular challenges of Ohio homeownership. Because of this, its customer reviews show above average satisfaction ratings. What the company refers to as “the ERIE Difference” is what makes this organization noteworthy. Erie Insurance focuses on providing impeccable and trustworthy customer service. In fact, the organization always keeps four basic principles top of mind: honesty, decency, service, and affordability. Since its inception, Erie Insurance has prided itself on providing high-quality coverage. Once a grassroots concept, Erie Insurance now has approximately 5 million policies in place.

Erie policies begin with basic coverage that you can build on to create a customized policy tailored to your particular needs. Customers can choose between various customization options to add to their policies. Some of the options include coverage for water backup and sump overflow, personal liability, identity recovery, and service line protection. Erie Insurance provides coverage that you might not find anywhere else, including the coverage of living expenses. When you have to leave your home while it is being repaired, Erie Insurance offers coverage for those living costs. Furthermore, you can also receive personal liability protection anywhere in the world, not just your home.

Although Erie's premiums are for customers with good credit, those with poor credit may find themselves paying more than the national average. However, the premium cost may be offset by their discounts for home safety features, advance quotes, and bundled policies. One of the ways that customers can lower their premium with Erie Insurance is by adding fire alarms, automatic sprinkler systems, and a burglary alarm. You can also save money by bundling your Erie Insurance auto and homeowners insurance. Finding ways to save money is important when it comes to insurance, and Erie Insurance agents are always willing to help you when you need to tighten your budget.

Erie Insurance has agents throughout Ohio to offer you insurance expertise coupled with the local knowledge necessary to ensure that you're getting the right coverage for your area. When doing research on insurance providers, it’s important to compare the costs and value of each company. On the Erie Insurance website, customers can find a chart that compares what Erie Insurance offers with what other insurance providers typically offer. This chart features important factors like theft, personal property coverage, coverage for valuable items, and more. For instance, the chart indicates that the 100% Guaranteed Replacement Cost that Erie Insurance offers is better than what other insurance providers offer.

State Farm Insurance Company

A highly reputable national insurance provider with local offices across Ohio, State Farm Insurance Company offers competitive rates with coverage options that are dependable, easy to understand, and customizable. State Farm offers coverage for items that other insurance providers might not, including cameras, musical equipment, swing sets, lawn decorations, and more. If you have a lot of miscellaneous, yet valuable items in your home that you want to protect, State Farm is a great choice to consider for homeowners insurance.

When you’re a policyholder with State Farm, you can be sure that your policy will cover damage for the most random situations that you can’t prepare for. From storms and natural disasters to vandalism and burglary, you will feel prepared to fight the financial burdens that life unexpectedly throws your way. State Farm is also very clear on what it’s insurance policies do not cover, including damage from a flood, earthquakes, and insects or domestic animals.

State Farm’s add-ons are clearly outlined on its website, which makes it easy for first-time policyholders who are unfamiliar with insurance jargon. By reading through the various offerings, you will get a better idea of how to tailor your policy for your home and family—with the help of a State Farm agent, of course. State Farm's well-organized website is especially useful for new homeowners who need advice on how to ensure their home is as free of potential risks as possible.

State Farm even offers a blog with additional information about being a homeowner, preparing to move to another location, and creating a home inventory—an essential step in the homeowners insurance process. Everything with State Farm is digitized, so getting a quote, paying your bill, and managing your claims and policy coverages is simple. State Farm's premiums are higher than some of the smaller Ohio carriers on our list, but they do offer various discounts that eligible customers can select, including discounts for having alarm systems, bundling State Farm auto and homeowners policies, and having impact-resistant roofing. You can also save money by increasing your deductible, which is the monthly cost of the insurance policy.

At first glance, you might want to rule out State Farm because it is not as affordable as other insurance providers. However, when looking for homeowners insurance, it’s important to keep value in mind. With the ample coverage and discounts that State Farm offers, it is still a great option to consider. If you have many valuables in your home, you need a reliable and reputable insurance provider like State Farm.

USAA Insurance

The United Services Automobile Association (USAA) is an insurance provider that proudly offers discounted premiums to former members of the armed services and their direct family members. As a result, if this requirement doesn’t apply to you, you cannot become a policyholder at USAA. Because USAA is deeply ingrained in the military community, its sole purpose is to help those in need. When you join USAA as a policyholder, you join an insurance provider that is completely dedicated to you and your family. Customer service is of the utmost importance to USAA. If you’re looking for an insurance provider that will not leave your side, and you qualify to join, USAA is a great option to consider.

The USAA's services extend from insurance coverage to banking, investment, and retirement services, and USAA offers additional discounts for bundling of policies, as well as length of membership. In addition, members of USAA receive discounts for a variety of other goods and services, including car rentals, travel, home security systems, new vehicles, and moving and storage services. Not only does USAA provide all of these services, but they also want to make sure that you’re knowledgeable about the importance of insurance.

The USAA website contains an advice section where it publishes articles about owning a home, being in the military, saving for emergency situations, and more. This is an excellent tool that is accessible to everybody, not just policyholders. This level of service exemplifies the kind of customer support that USAA provides. It’s not just about having a homeowners insurance policy. It’s about learning how to make smart decisions, which often lead to decreasing your risks and claims.

The homeowners insurance that USAA offers covers many things that you can expect from other insurance providers, including theft, most weather-related damage, fire, vandalism, and liability. One special feature that you can include in your policy is dwelling coverage. Dwelling coverage covers the cost of repairs to your home, if the event that caused the damage is deemed applicable. You can also receive coverage for home-sharing, in the case that you rent out part of your home. However, one of the most special offers that USAA provides is the coverage of military uniforms in the event of a loss in active duty or deployed members.

Overall, USAA homeowner insurance rates are lower than the national average, which makes it a great option for those looking to cut back on spending. The only downside to USAA is that it is only available to former members of the military and their direct family members. Active and retired military members, their spouses and children are eligible for coverage, but parents, siblings, and other family members are not. As a national insurance provider for active duty and retired members of the military and their families, the USAA has agents and offices across the United States.

Other Considerations for Your Ohio Homeowners Insurance Policy

When selecting your policy, be sure to compare your quotes apples-to-apples, that is, requesting the same coverage levels for each coverage. A policy that seems too good to be true might just be offering a higher deductible or lower coverage than a more expensive competitor. Your quote should include coverages specific to Ohio. While you are at low risk of earthquake or tropical storm damage, for example, you may be at higher risk of flooding, hail or snow damage. Flood coverage is particularly critical, as many homeowners policies exclude flood coverage, so you may wish to purchase a supplemental policy.

Most importantly, remember that the policy for each home is different depending on the location of your home, as well as its age, condition, and value. Be sure to choose an agent who will take your specific needs into consideration in order to create a policy tailored to your specific needs.

How to Compare Providers to Find Affordable Home Insurance

Finding the perfect homeowners insurance provider is not easy—no matter how long you’ve owned a home. Whether you’re starting your first insurance policy or looking to switch to a new provider, it’s easy to get lost in the numerous coverage options and pricing when doing research. A good insurance provider will not only offer a breakdown of pricing, basic coverage, and optional add-ons, but it will also describe its philosophy, culture, and purpose.

To help get you started, we’ve narrowed down the research process to three important factors: affordability, personalization, and customer service. These are not the only factors to consider when looking for an insurance provider, but they are important to keep top of mind. In the end, the most important thing that you want to get out of your insurance provider is value. The cost of car insurance can add up quickly, but when you have a provider whose coverage makes you feel safe, secure, and protected, the value is irreplaceable.

When researching different insurance providers, keep these three factors top of mind.

Affordability

There are many options for dependable homeowners insurance providers, but they might not all be affordable. Your home is the center of your life and your biggest asset, so this is not an expense that you can simply cut out. However, you can find an insurance provider that not only offers good rates, but that actively tries to help you find ways to save money.

For instance, many insurance providers offer reduced premiums and rates to those who own newer homes, have security systems around the house, or have multiple insurance policies in place. Additionally, some insurance providers offer to lock your rate—no matter what. Knowing that your rate will not unexpectedly increase provides a feeling of true financial security. Finding an insurance provider that offers options like these will save you money in the long run. Don’t settle for providers that don’t stress the importance of affordability.

Personalization

As a consumer, it’s important to find an insurance provider that understands you as an individual. Not one insurance policy meets the needs of all homeowners. That’s why it is important to select an insurance provider that is not only dependable and affordable, but also flexible. Insurance providers should offer basic plans that meet all legal requirements. However, if you are looking for extra coverage to feel more protected, find an insurance provider that offers an abundance of optional add-ons.

These options are there if you need them, but are not required. For instance, many insurance providers offer to pay for living expenses when you need to live outside of your house during repairs or reconstruction. Other examples of add-ons include umbrella coverage and coverage for loan or lease gaps. The policy and coverage that you choose should represent your needs, and the agents you work with should help you pick the right coverage every step of the way. When it comes to feeling secure, nothing is more important than having a reliable insurance provider that prepares you for life’s greatest curveballs.

Customer Service

With homeowners insurance, customer service is not something that you want to compromise on—no matter the affordability. Insurance can be a scary and challenging topic. Imagine a burglary occurring at your home and you not knowing the first step to take with your insurance provider. Even worse, imagine not ever getting the answers you need. That’s why it is important that the insurance provider that you choose offers superb customer service. When you have an emergency, you want to be sure that your insurance provider, its agents, and its employees are there to help you. Whether it’s reporting a claim, making a payment, or reviewing your policy, your insurance provider should be willing to provide guidance on any matter. Part of great customer service involves answering questions, providing solutions, and offering advice. When looking for an insurance provider, ask around and read credible customer reviews to determine whether the customer service meets your standards.

To get started finding your homeowners insurance, take a look at the top 10 places to get most affordable home insurance in Ohio. Then, get a free quote and meet with an agent to discuss price, coverage, and the overall value.

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.