We are here to help you understand the process of getting life insurance at your 33 years. First, we will outline some smart reasons to go for life insurance at age 33 and tips on what to look for in the best cover. The second part provides an overview of the most common types of policies available today and then details how to choose the right one for your needs. Finally, we'll go over how to compare the prices of different plans. So let's get down to business!

What We'll Cover

- Why Get Life Insurance at Age 33?

- What to Look for in a Life Insurance Policy for 33-Year-Olds

- Top 6 Cheap Life Insurance Providers for 33-Year-Olds

- Sproutt

- SelectQuote

- Mutual of Omaha

- AIG, American International Group

- MassMutual

- Fidelity Investments

- States with the Best Life Insurance premiums for 33-Year-Olds

- There You Go!

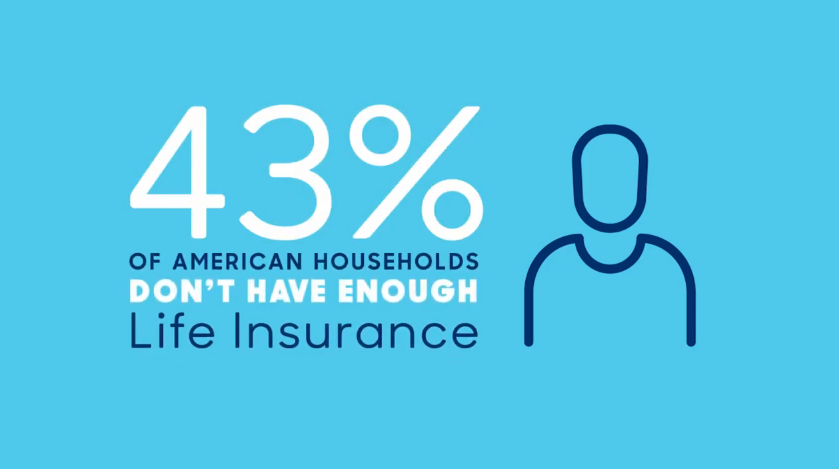

Why Get Life Insurance at Age 33?

If you aspire to retire by 65, you should be looking to purchase life insurance as early as possible. However, if you want to retire earlier than that, there are still good reasons to start thinking about it now. So here are the top reasons you should get life insurance at the age of 33:

- You have a family now. By age 33, chances are you've settled down and have a few children. And if they aren't born yet, we bet you have solid plans about the same. Either way, it makes sense to think about life insurance if they are likely to need financial support in the future. Having life insurance means that you don't leave your family financially unprepared after your demise.

- You could avoid medical hardships. Your doctor has probably recommended life insurance for all kinds of reasons, but one common reason is to help protect against medical emergencies. By paying more per month than you otherwise would for health care premiums, you can increase the likelihood that you'll reach retirement age without needing to take out emergency loans or sell off assets.

- Your finances and credit score are relatively healthy. If you're ready to buy a house, invest some money, or plan for anything else that requires money, you might want to start thinking about life insurance first. Buying life insurance isn't just about ensuring your well-being - it's also about protecting those who rely on you, securing a mortgage loan, protecting your business, etc. You can only realize these milestones at a young age when your finances and credit score are still relatively healthy.

- You could save on premiums. Getting life insurance in your 30s can be pretty affordable. That's because you aren't in the same risk category as those in their 40s, 50s, or 60s. So you're likely to attract lower rates than older folks, especially if your health status is uncompromised.

What to Look for in a Life Insurance Policy for 33-Year-Olds

Not all life insurance policies are befitting for 33-year-olds, so you want to choose carefully. Here are a few tips/recommendations about what to look for:

- Get enough coverage for today and tomorrow. The most important thing to look for is how much coverage you're getting. This amount depends on several factors, including your current age, salary, how long you expect to work, etc. The key here is to ensure you buy enough coverage so that your next of kin will have the resources they need to fulfill their obligations.

- Ensure you review the terms. Terms differ depending on the type of policy you purchase. For example, whole-life policies often carry greater costs than term policies. You should know whether any part of the premium payment covers claims that aren't related to death. It's also worth checking out annuities. They generally come with high fees that can eat away at your investment earnings faster than other types of policies.

- Shop around for discounts. Sometimes, there are discounts associated with purchasing multiple policies from different companies. For instance, you could qualify for $500 off each additional ten years of coverage. If you take advantage of this, you'll be paying less over time.

- Review your options. You may not have many choices when choosing a cheap life insurance provider for 33-year-olds, especially if you've had an unpleasant experience in the past. But there are other ways to shop around, such as asking friends or family members for advice. Even better, ask your employer what options it provides. Remember, when selecting a carrier, you don't necessarily need to go with the cheapest company. You just need to feel comfortable with its product offerings and underwriting approach.

- Compare the price of different plans to determine which one best meets your needs. Read reviews about specific carriers before deciding to get a sense of customer satisfaction.

Top 6 Cheap Life Insurance Providers for 33-Year-Olds

In this section, we'll discuss each life insurance provider exclusively, providing information about the type of policy they offer, benefits, price, and coverage for both males and females. So let's get started.

Sproutt

Sproutt offers both whole and term life insurance policies, and it uses custom questionnaires to determine your Quality of Life Index. With this tool, you can provide answers to questions like "How happy would you be if you lost all your money?" and "What is the likelihood that you'd commit suicide?" These responses are then used to calculate your QLI score, and Sproutt determines how much coverage you're eligible for based on the outcome.

Of course, other factors like health status, smoking habits, and gender also determine your premium rating and eligibility. Here are a few examples of average rates for 33-years-old males and females located in New York (the rate varies per state)

Term life insurance

Rates for a $500,000, 20-year term policy for 33-yr-old Females:

- $22 per month for a non-smoker

- $63 per month for a smoker

Rates for a $500,000, 20-year term policy for 33-yr-old Males:

- $27 per month for a non-smoker

- $77 per month for a smoker

Whole life insurance

Rates for $1 million coverage for 33-yr-old Females:

- $435 per month for a non-smoker

- $807 per month for a smoker

Rates for $1 million coverage for 33-yr-old Males:

- $491 per month for a non-smoker

- $938 for a smoker

SelectQuote

SelectQuote is a cheap life insurance provider for 33-year-olds that has two main products available: SelectQuote Term and SelectQuote Whole. Both cover the same primary benefits, but the latter carries a higher cost because it includes more features.

As far as pricing goes, SelectQuote offers a variety of options for males and females. Average monthly premiums for 33 yr-old males and females in New Jersey:

Term life insurance

Rates for 33-yr-old Females

- $11 per month for a non-smoker

- $25 per month for a smoker

Rates for 33-yr-old Males

- $13 per month for a non-smoker

- $26 per month for a smoker

Whole life insurance rates:

Rates for 33-yr-old Females

- $831 per year for a non-smokers

- $1683 per year for smokers

Rates for 33-yr-old Males

- $1069 per year for a non-smoker

- $2149 per year for smokers

Mutual of Omaha

Mutual of Omaha offers three types of life insurance policies: Term, Whole, and Universal Life. They all carry similar benefits but vary in their pricing structure. For example, a 30-year term plan costs $50 per month for a single person, while a 60-year term plan costs only $30 per month. A universal life policy costs $20 per month, while a whole life policy costs $15 per month.

Mutual of Omaha also provides riders such as accidental death and dismemberment, critical illness, and long-term care. Below are the average monthly premiums for 33 yr old males and females living in Illinois:

Term life insurance

Policy rates for 33-yr-old Female:

- $12 per month for a non-smoker

- $24 per month for a smoker

Policy rates for 33-yr-old Male:

- $14 per month for a non-smoker

- $28 per month for a smoker

Universal life insurance

Policy rates for 33-yr-old Female:

- $18 per month for a non-smoker

- $36 per month for a smoker

Policy rates for 33-yr-old Male:

- $21 per month for a non-smoker

- $42 per month for a smoker

AIG, American International Group

AIG offers four different types of life insurance policies: Term, Whole, Variable, and Universal. Each type provides different levels of protection and pricing structures. For example, an individual with a $100,000 face value term policy will pay around $17 per month, while someone with a $1 million face value whole life policy will pay about $200 per month.

Variable life insurance allows customers to choose between fixed or variable payments. For example, a customer can select either a $100,000 or $250,000 face value policy at a monthly cost of $35. Universal life insurance is designed to provide individuals with a guaranteed income level after they die. It's based on a percentage of the insured's investment account balance.

MassMutual

MassMutual is one of the oldest insurers in the country, having been launched on 15 May 1851 in Springfield, Massachusetts. This cheap provider for 33-year-olds offers two policies: whole and term life insurance. Both policies offer similar coverage but differ in price.

For instance, MassMutual's 30-year term plan carries a monthly cost of $34 for males and $40 for females age 33. On the other hand, a 50-year term plan costs around $58 per month for a man and $68 per month for a woman age 33. It's also critical to note that both plans include a $500,000 face value benefit, 100 percent cash surrender value, and no medical exam requirement.

Fidelity Investments

Whereas Fidelity is known for dealing with investment options, it also offers various life insurance products tailored for 33-year-olds. In particular, the carrier offers three types of life covers; Term, Whole, and Universal.

The company claims that its "flexible approach" makes it easier to find the right policy. For example, Fidelity's 30-day money-back guarantee means that you don't have to commit yourself to a long-term contract. You can cancel your policy within 30 days if you aren't satisfied with the product. In addition, Fidelity provides free online tools to help consumers compare their options.

The following section compares the prices of Fidelity's various life insurance products suited for 33-year-olds across the country:

Term life insurance

Rates for 33-yr-old Males:

- $33 per month for non-smokers

- $59 per month for smokers

Rates for 33-yr-old Females:

- $28 per month for non-smokers

- $56 per month for smokers

Whole life insurance rates:

Rates for 33-yr-old Males:

- $1049 per year for non-smokers

- $2169 per year for smokers

Rates for 33-yr-old Females:

- $841 per year for non-smokers

- $1521 per year for smokers

Variable life insurance rates

Rates for 33-yr-old Males:

- $43 per month for non-smokers

- $73 per month for smokers

Rates for 33-yr-old Females:

- $38 per month for non-smokers

- $63 per month for smokers

States with the Best Life Insurance premiums for 33-Year-Olds

For a $500K Death Benefit and 10-year term policy:

| State | Average Monthly Cost |

| Ohio | The average Life Insurance cost for 33 yr olds in Ohio is $16.74 per month for male and $13.47 per month for a female. |

| Kentucky | The average Life Insurance monthly premium for 33 years olds in Kentucky is $13.56 for females and $16.08 for males. |

| Florida | The average Life Insurance premium in Florida for a 33 years old is $17.98 per month for a female and $20.02 per month for a male. |

| Illinois | The average premium of a Life Insurance for 33 yr-olds in Illinois is $12.59/month females and $14.80 males |

| Minnesota | The average Life Insurance rate in the state of Minnesota for a 33 years-old is $15.99 monthly for a female and $19 monthly for a male |

| Michigan | The average Life Insurance cost for 33 yr olds in Michigan is $22 per month for male and $18.98 per month for a female. |

| Massachusetts | The average Life Insurance premium in Massachusetts for a 33 years old is $19.61 per month for a female and $20.79 per month for a male. |

There You Go!

And that's it for the best cheap life insurance providers for 33-year-olds. Hopefully, this detailed guide was insightful, and you learned a thing or two about how to approach the purchase of life insurance in your 30s. Remember, you have to weigh your options, get a policy for today and tomorrow, shop around for discounts, review the terms extensively, and compare the price of different plans to determine the one that satisfies your needs.

Cheap Life Insurance Quotes by Age

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.

![Can You Get Life Insurance for Your Parents? [Complete Guide]](/assets/images/4195a596c9c2e2afdae7712685f340fc.png)