Obviously, getting a DUI is less than ideal and best avoided. However, everyone makes mistakes. What matters most is how you move forward. After a DUI, it's harder to find car insurance and, on average, rates increase by 96% costing an extra $127 every month! Drivers with a DUI on their record are considered high-risk for years afterward.

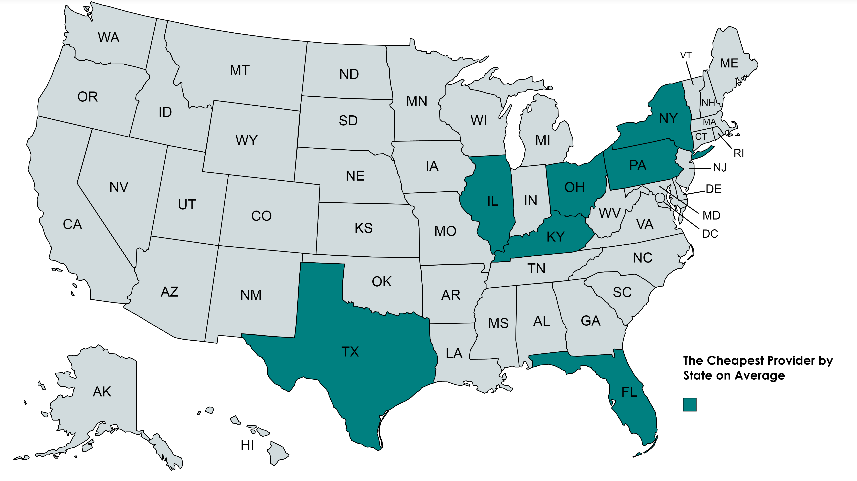

That's why it's so important to be well-informed and get the best deal you can. We'll cover some general information regarding car insurance costs and average nationwide rates. Then we'll dive a little deeper into Texas, Florida, New York, Illinois, Pennsylvania, Ohio, and Kentucky specifically, including the cost of cheap DUI car insurance in each state.

What We'll Cover

- Providers of Cheap DUI Car Insurance Nationwide

- Cheap DUI Car Insurance in Texas

- Cheap DUI Car Insurance in Florida

- Cheap DUI Car Insurance in New York

- Cheap DUI Car Insurance in Illinois

- Cheap DUI Car Insurance in Pennsylvania

- Cheap DUI Car Insurance in Ohio

- Cheap DUI Car Insurance in Kentucky

- Finding a Cheap DUI Car Insurance Rate

- Final Thoughts

Providers of Cheap DUI Car Insurance Nationwide

Progressive is the cheapest large, national provider for full coverage insurance on average if you've had a recent DUI.

Top 4 Cheap DUI Car Insurance Providers Nationally:

- Progressive: $163/mo

- State Farm: $211/mo

- Geico: $241/mo

- Allstate: $300/mo

If you're a current or former member of the military, you may be eligible for USAA Insurance which has lower rates than Progressive but only serves former and active military members and their families, so it isn't generally included in the data. Small, local insurance agencies may have better rates than the large national insurers, so ask around and compare rates. In 68% of states (and D.C.) the cheapest post-DUI car insurance provider wasn't among the 10 largest national companies so don't just check the biggest names.

The Cheapest Provider by State on Average:

- Texas: Dairyland ($687/yr)

- Florida: Geico ($1,593/yr)

- New York: Progressive ($1,060/yr)

- Illinois: Kemper ($589/yr)

- Pennsylvania: Penn National ($911/yr)

- Ohio: American Family ($682/yr)

- Kentucky: Safe Auto ($1,466/yr)

Cheap DUI Car Insurance in Texas

With so many factors affecting car insurance costs, these averages won't represent everyone's experience. However, they should give you a decent idea of what's considered cheap DUI car insurance in Texas, which provider has the lowest rates, and generally what you might expect to pay. We'll list the top 5 companies to call for cheap DUI car insurance in Texas for each age group to help narrow it down a bit.

Cheap DUI Car Insurance in Texas for 20-Year-Olds:

| Company | Annual Cost |

| Geico | $1,156 |

| Houston General | $1,273 |

| Dairyland | $1,398 |

| Kemper | $1,314 |

| Esurance | $1,424 |

Cheap DUI Car Insurance in Texas for 30-Year-Olds:

| Company | Annual Cost |

| Esurance | $1,432 |

| Geico | $1,655 |

| Republic Group | $1,739 |

| Houston General | $2,272 |

| National General | $2,304 |

Cheap DUI Car Insurance in Texas for 40-Year-Olds:

| Company | Annual Cost |

| Esurance | $1,365 |

| Geico | $1,639 |

| Republic Group | $1,678 |

| Houston General | $2,091 |

| National General | $2,203 |

Cheap DUI Car Insurance in Texas for 50-Year-Olds:

| Company | Annual Cost |

| Esurance | $1,257 |

| Republic Group | $1,545 |

| Geico | $1,566 |

| Houston General | $1,933 |

| National General | $2,150 |

Cheap DUI Car Insurance in Texas for Drivers 65+:

| Company | Annual Cost |

| Esurance | $1,407 |

| Republic Group | $1,521 |

| Geico | $1,627 |

| Houston General | $1,854 |

| State Farm | $2,119 |

Cheap DUI Car Insurance in Florida

While car insurance costs, on average, nearly double after a DUI nationally, drivers with the minimum, often cheapest car insurance coverage, in Florida face less than a 50% average increase in cost. These are the top 5 providers of cheap DUI car insurance in Florida by age group.

Cheap DUI Car Insurance in Florida for 20-Year-Olds:

| Company | Annual Cost |

| Geico | $957 |

| Allstate | $1,214 |

| Direct Auto | $1,347 |

| State Farm | $1,807 |

| Progressive | $2,253 |

Cheap DUI Car Insurance in Florida for 30-Year-Olds:

| Company | Annual Cost |

| Geico | $2,718 |

| State Farm | $2,798 |

| Direct Auto | $3,234 |

| Allstate | $3,402 |

| Progressive | $3,711 |

Cheap DUI Car Insurance in Florida for 40-Year-Olds:

| Company | Annual Cost |

| Geico | $2,568 |

| State Farm | $2,743 |

| Direct Auto | $2,815 |

| Allstate | $3,400 |

| Progressive | $3,602 |

Cheap DUI Car Insurance in Florida for 50-Year-Olds:

| Company | Annual Cost |

| Geico | $2,489 |

| State Farm | $2,657 |

| Direct Auto | $2,710 |

| Allstate | $3,265 |

| Progressive | $3,302 |

Cheap DUI Car Insurance in Florida for Drivers 65+:

| Company | Annual Cost |

| Geico | $2,340 |

| State Farm | $2,543 |

| Direct Auto | $2,751 |

| Allstate | $3,275 |

| Progressive | $3,300 |

Cheap DUI Car Insurance in New York

New York has a high standard for minimum coverage. They require you to have liability insurance, personal injury protection, and uninsured motorist bodily injury coverage, and quite a lot of it. These are the top 5 providers of cheap DUI car insurance in New York by age group.

Cheap DUI Car Insurance in New York for 20-Year-Olds:

| Company | Annual Cost |

| Progressive | $1,260 |

| New York Central Mutual | $1,434 |

| Allstate | $2,264 |

| Utica National | $2,377 |

| Erie | $2,406 |

Cheap DUI Car Insurance in New York for 30-Year-Olds:

| Company | Annual Cost |

| Progressive | $1,392 |

| New York Central Mutual | $2,499 |

| Allstate | $2,868 |

| Erie | $2,948 |

| Geico | $3,998 |

Cheap DUI Car Insurance in New York for 40-Year-Olds:

| Company | Annual Cost |

| Progressive | $1,335 |

| New York Central Mutual | $2,517 |

| Erie | $2,788 |

| Allstate | $2,867 |

| Geico | $3,974 |

Cheap DUI Car Insurance in New York for 50-Year-Olds:

| Company | Annual Cost |

| Progressive | $1,242 |

| New York Central Mutual | $2,416 |

| Erie | $2,697 |

| Allstate | $2,955 |

| Encompass | $3,908 |

Cheap DUI Car Insurance in New York for Drivers 65+:

| Company | Annual Cost |

| Progressive | $1,357 |

| New York Central Mutual | $2,226 |

| Erie | $2,713 |

| Allstate | $3,077 |

| State Farm | $3,724 |

Cheap DUI Car Insurance in Illinois

Illinois has areas of wide-open countryside and densely populated cities so car insurance rates will depend heavily on where you live. These are the top 5 providers of cheap DUI car insurance in Illinois divided by age.

Cheap DUI Car Insurance in Illinois for 20-Year-Olds:

| Company | Annual Cost |

| Grange | $893 |

| Erie | $936 |

| Geico | $1,030 |

| Travelers | $1,042 |

| Progressive | $1,085 |

Cheap DUI Car Insurance in Illinois for 30-Year-Olds:

| Company | Annual Cost |

| Grange | $1,147 |

| Pekin | $1,392 |

| Progressive | $1,473 |

| State Farm | $1,483 |

| Erie | $1,588 |

Cheap DUI Car Insurance in Illinois for 40-Year-Olds:

| Company | Annual Cost |

| Grange | $1,059 |

| Pekin | $1,280 |

| Progressive | $1,353 |

| Erie | $1,425 |

| Mercury | $1,434 |

Cheap DUI Car Insurance in Illinois for 50-Year-Olds:

| Company | Annual Cost |

| Grange | $1,156 |

| Pekin | $1,235 |

| Progressive | $1,247 |

| Erie | $1,300 |

| Mercury | $1,396 |

Cheap DUI Car Insurance in Illinois for Drivers 65+:

| Company | Annual Cost |

| Grange | $1,007 |

| Pekin | $1,299 |

| Progressive | $1,310 |

| State Farm | $1,327 |

| Erie | $1,342 |

Cheap DUI Car Insurance in Pennsylvania

Pennsylvania is the sixth most well-insured state (just short of making the top 5) with only 6% uninsured drivers. Population density varies wildly by region so these averages may not accurately represent what you'll see. These are the top 5 providers of cheap DUI car insurance in Pennsylvania by age.

Cheap DUI Car Insurance in Pennsylvania for 20-Year-Olds:

| Company | Annual Cost |

| QBE | $901 |

| Allstate | $947 |

| Geico | $1,021 |

| Esurance | $1,031 |

| Progressive | $1,070 |

Cheap DUI Car Insurance in Pennsylvania for 30-Year-Olds:

| Company | Annual Cost |

| Esurance | $1,119 |

| Penn National | $1,564 |

| Allstate | $1,664 |

| Erie | $1,697 |

| Progressive | $1,859 |

Cheap DUI Car Insurance in Pennsylvania for 40-Year-Olds:

| Company | Annual Cost |

| Esurance | $1,085 |

| Penn National | $1,422 |

| Erie | $1,623 |

| Allstate | $1,656 |

| Progressive | $1,708 |

Cheap DUI Car Insurance in Pennsylvania for 50-Year-Olds:

| Company | Annual Cost |

| Esurance | $1,098 |

| Penn National | $1,231 |

| Progressive | $1,584 |

| Allstate | $1,593 |

| Erie | $1,594 |

Cheap DUI Car Insurance in Pennsylvania for Drivers 65+:

| Company | Annual Cost |

| GrangeEsurance | $1,185 |

| Penn National | $1,243 |

| Erie | $1,620 |

| Allstate | $1,665 |

| Progressive | $1,681 |

Cheap DUI Car Insurance in Ohio

Ohio was the site of the first recorded car accident in history and has over 100 racetracks, hosting races for vintage motorcycles as well as NASCAR and IndyCar. Luckily for you, this doesn't affect your insurance rates. These are the top 5 providers of cheap DUI car insurance in Ohio per age group.

Cheap DUI Car Insurance in Ohio for 20-Year-Olds:

| Company | Annual Cost |

| Esurance | $261 |

| American Family | $766 |

| Allstate | $810 |

| Geico | $913 |

| Progressive | $946 |

Cheap DUI Insurance in Ohio for 30-Year-Olds:

| Company | Annual Cost |

| American Family | $1,013 |

| Progressive | $1,259 |

| State Farm | $1,442 |

| Geico | $1,514 |

| Erie | $1,575 |

Cheap DUI Car Insurance in Ohio for 40-Year-Olds:

| Company | Annual Cost |

| American Family | $928 |

| Progressive | $1,151 |

| State Farm | $1,413 |

| Geico | $1,486 |

| Erie | $1,500 |

Cheap DUI Car Insurance in Ohio for 50-Year-Olds:

| Company | Annual Cost |

| American Family | $860 |

| Progressive | $1,055 |

| Progressive | $1,385 |

| Erie | $1,471 |

| Geico | $1,477 |

Cheap DUI Car Insurance in Ohio for Drivers 65+:

| Company | Annual Cost |

| American Family | $877 |

| Progressive | $1,121 |

| State Farm | $1,302 |

| Erie | $1,478 |

| Frankenmuth | $1,485 |

Cheap DUI Car Insurance in Kentucky

Insurance rates in Kentucky are pretty high to begin with, so this is a rough one. It can be a large portion of your income before a DUI so prepare yourself. This won't be pretty. These are the top 5 providers of cheap DUI car insurance in Kentucky by age group.

Cheap DUI Car Insurance in Kentucky for 20-Year-Olds:

| Company | Annual Cost |

| Geico | $1,277 |

| State Farm | $2,033 |

| Westfield | $2,052 |

| Encova | $2,242 |

| Progressive | $2,342 |

Cheap DUI Car Insurance in Kentucky for 30-Year-Olds:

| Company | Annual Cost |

| State Farm | $2,629 |

| Grange | $2,853 |

| Progressive | $2,903 |

| Geico | $2,950 |

| Nationwide | $3,620 |

Cheap DUI Car Insurance in Kentucky for 40-Year-Olds:

| Company | Annual Cost |

| State Farm | $2,579 |

| Progressive | $2,687 |

| Grange | $2,855 |

| Geico | $2,901 |

| Nationwide | $3,569 |

Cheap DUI Car Insurance in Kentucky for 50-Year-Olds:

| Company | Annual Cost |

| Progressive | $2,490 |

| State Farm | $2,529 |

| Grange | $2,675 |

| Geico | $2,886 |

| Kentucky Farm Bureau | $3,173 |

Cheap DUI Car Insurance in Kentucky for Drivers 65+:

| Company | Annual Cost |

| State Farm | $2,370 |

| Grange | $2,603 |

| Progressive | $2,657 |

| Geico | $2,954 |

| Nationwide | $3,358 |

Finding a Cheap DUI Car Insurance Rate

Minimum coverage likely isn't worth the savings. The protection from the bare minimum insurance allowed in your state is usually sorely lacking, so if you are in an accident, you could pay much more out of pocket than you saved. Let's go over some other important tips for finding cheap DUI car insurance in your state.

Tips for Finding Cheap DUI Car Insurance in Your State

Start ASAP: Your rate will nearly always rise after a DUI and many insurers will even drop you, so to save the most money and avoid a lapse in coverage, start immediately.

Shop Around: Contact different providers in your area including both large national insurance companies and small local agencies. Get as many quotes as possible.

Be Honest: To get an accurate rate quote you'll have to be upfront about having gotten a DUI.

Seek Out Online Tools: Rate comparison tools like NerdWallet's can show you rates from many companies at once.

Final Thoughts

Remember, this won't affect you forever. Your rates can start to come down in as little as three to five years. Averages are often far from an accurate representation of what to expect on an individual level. Your situation is unique, and ultimately, there's no way to say with any level of certainty if your outcomes will match the current trends and averages seen in the available data. However, you can go into your search with the right information and tactics to increase your odds of obtaining the best results. Hopefully, now, you're prepared to do just that.

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.

![Does Personal Car Insurance Cover Rental Cars?[Cheapest Options Listed]](/assets/images/f2074cd33086632849c2ee1dc052e3cb.png)

![Will Insurance Pay for Rental Car During Repairs?[You Must Know This]](/assets/images/2e80f9049def845cfdbfed4c6f53c013.png)