Gone are the days when investing in the future was a luxury limited to Wall Street gurus or even financially savvy investors. These days, one of the biggest challenges for many beginning investors is finding the best investing platform for their needs.

What We'll Cover

Comparing Acorns vs Vanguard largely comes down to pinpointing which one is better aligned with your goals and investing style. Let’s take a closer look at each platform, what it brings to the table, and how it can help you plan for your financial future.

What Is Acorns?

Acorns is an investing app that was founded in 2012 with the novice or hands-off investor in mind. Within minutes, Acorns allows new investors to sign up for investment, IRA retirement, checking, and/or child savings accounts.

The app uses a robo-advisor-style questionnaire to match each user with the best portfolio options for their investment goals and risk tolerance. Investors then choose from a variety of options for funding their accounts on an ongoing basis, some of which are what makes the average Acorns review shine.

Not only can investors set-up recurring investments from their bank accounts, but also opt into spare change roundups from connected credit or debit cards. Acorns also offers a unique rewards program that automatically invests cash back from thousands of retailers.

- Robo advisor features make finding appropriate investments effortless

- Unique contribution options include spare change roundups and cashback rewards from thousands of participating retailers

- Best for new or hands-off investors

- Automatic account rebalancing

- Fees are on the higher side, especially for smaller accounts

- No human advisor options

What is Vanguard?

Vanguard has been around since 1975 and has developed a reputation as one of the best full-service brokerages for mutual fund and ETF investors. Their platform also offers investors access to stocks, fixed-income securities, bonds, options, and cash investments.

In addition to brokerage and IRA retirement accounts, Vanguard also offers accounts geared towards businesses and non-profit organizations.

Vanguard investors can chose to self-direct their own accounts or utilize Vanguard’s digital advisor, which works in a similar way to what you’ll find on Acorns. Depending on your account balance, you can also enjoy personalized investment advice, a dedicated financial advisor, or an entire wealth management team.

- Huge selection of no-cost or low-cost mutual funds and ETFs

- Commission-free trades on individual stocks and ETFs

- Best for long-term, passive investors

- Self-directed, digital, or human advisory options

- Some funds may be too expensive for beginning investors

- Fractional shares are not available for stocks or ETFs

Differences between Acorns and Vanguard Features

A solid Acorns vs Vanguard review will reveal that each investing platform has its own unique features that cater to different types of investors.

What is Acorns round up?

One of Acorn’s most interesting features is its spare change roundup option. Investors can link any credit or debit card to their account and then continue to use it to make everyday purchases.

Acorns will automatically round up the spare change from every purchase to the nearest dollar and invest the difference on the user's behalf.

Additionally, Acorns is unique in that it offers a cash back rewards program. Each time investors make purchases from one of over 12,000 participating brands, they have a chance to earn cash back savings that are automatically invested into their accounts.

Acorns also offers a digital checking account that includes a debit card with a build-in roundup feature, up to 10% in bonus investments, and no minimum or overdraft fees. Vanguard, on the other hand, bowed out of cash management accounts for larger account holders in 2019.

While both Acorns and Vangaurd offer mobile and desktop access, Vangurd is more of a traditional brokerage style experience.While the Acorns platform tends to be pretty straightforward as far as offering set-up options for various features, Vanguard’s is a bit more customizable.

What is the minimum account balance for Acorns and Vanguard?

Investors who choose to go with Vanguard's digital advisor can enjoy a similar “set it and forget it,” approach to that offered by Acorns. The main difference here is that you can start investing with a robot-advised Acorns account for as little as $5, while Vanguards digital investing service requires a minimum account balance of $3,000.

Unlike Acorns, however, Vanguard offers plenty of non-robo-advised choices for self-directed investors who would rather decide where their money is invested in far more detail.

| Acorns | Vanguard | |

| Account Types | - Brokerage - IRA - Checking - Children’s Investing Accounts |

- Brokerage - IRA - Small Business - 529 Savings - Organization - Trusts - Children’s Investing Accounts |

| Investments Available | ETF portfolios that consist of stocks, bonds, and cryptocurrencies | Stocks, bonds, ETFs, mutual funds, CDs, and options |

| Advisory Services | Robo-advised | Self-directed, robo-advised or human-advised options |

| Maintenance Fees | $3- $5/month | $20/year fee that's waived for clients who sign up for e-statements |

| Recurring Investment Option? | Yes | Yes |

| Promos | Free $10 sign-up bonus | Free 90-day digital advisor trial |

| Best for | - Hands-off, - long-term investors |

- Long-term - mutual fund, and - ETF investors |

Acorns and Vanguard Fees/Pricing

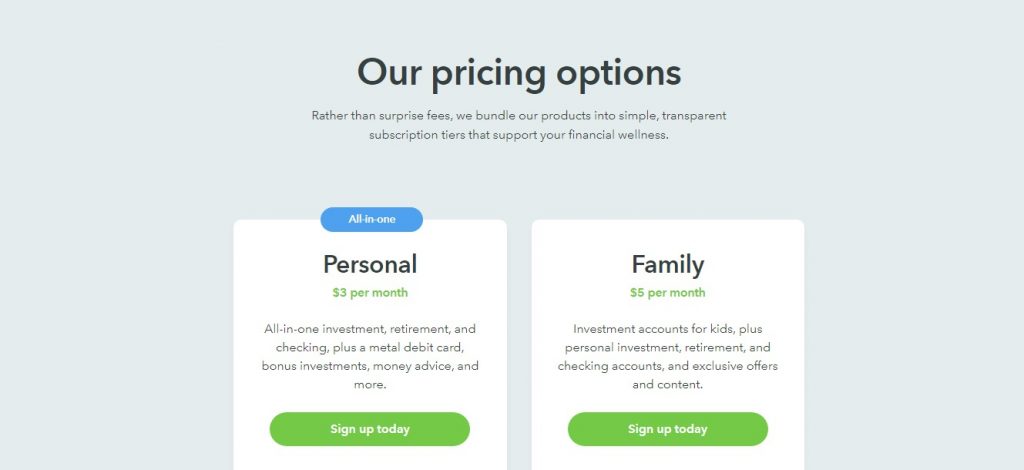

It’s hard to find an Acorns review that doesn’t delve into the issue of fees, which has become a bit of a sticking point for many investors. Acorns offers two different fees for each of their subscription tiers, including:

- Personal - $3/month

The personal tier offers access to investment, retirement, and checking accounts and all of the features associated with each.

- Family - $5/month

Family subscriptions offer all the benefits of a personal subscription, plus the option to open investment accounts for your children.

Over the course of a year, a personal subscription will run investors $36, while a family account will cost $60. How good or bad a deal this is will largely depend on your account balance.

If you’re investing several thousand a year, then the fee may not put too big of a dent in your savings. But if you’re only contributing spare change or a few hundred dollars a year, then these losses can add up very quickly.

Should you choose to go with Vanguard’s digital advisor account instead, your annual fees will come out to roughly 0.15% of your account each year. Any other account fees will depend on which features you choose to use.

Vanguard waives their usual annual $20 service fee for investors who simply sign up for electronic document delivery or those who have an account balance over $50,000. Overall, Vanguard’s fee structure is based more on percentages for optional services or investments, but the brokerage offers plenty of free and low-cost investment options as well.

Acorn vs Vanguard Bonuses and Promotions

While many brokerages routinely offer bonuses to new account holders, promos aren’t a huge strength in the average Acorns or Vanguard review. Acorns does offer a $10 bonus investment for new users as well as referral bonuses, while Vanguard digital advisor offers a fee-free 90-day trial period.

But both offers are pretty paltry when compared to other offers from other brokerages, like Schwab, Fidelity, or WeBull.

Vanguard shines more in its low-cost investment options, while many of Acorns' bonus features are built into things like its cash-back rewards program.

Investing Styles of Acorns vs Vanguard

If there’s one thing that Acorns and Vanguard have in common, it’s that both investing platforms are geared toward the long-term investor.

Neither are a particularly great choice for more active traders, as both of their strengths lie more in investments designed to compound over time.

How does Acorns invest your money?

The money that Acorns investors contribute to their accounts is exclusively invested in exchange traded funds or ETFs. Each of these ETFs contains a mixture of stocks, bonds, and in some cases, cryptocurrencies, that are designed to compound over various lengths of time.

While you can change the type of funds you invest in, overall, Acorns is geared more towards long-term profits than quick returns.

Can you day trade on Vanguard?

Yes! While it's possible to use Vanguard for short-term trading tactics, such as day or swing trading, Vanguard's platform wasn’t really designed with these strategies in mind. Active traders will have far better luck with the features offered by platforms such as Fidelity’s Active Trader Pro or TD Ameritrade’s ThinkOrSwim.

That said, both Vanguard and Acorns score a solid review when it comes to saving for retirement or other large purchases.

Ease of Use

When it comes to a review of the beginner-friendly features of Acorns vs Vanguard, both have a lot to offer.

Want a bottom-line Acorns review? The app offers a virtually effortless way for hands-off investors to set aside money for the future, even with little to no financial knowledge. While you can invest as much or as little as you like with Acorns, just keep the fee structure in mind when it comes to smaller account balances.

Vanguard’s digital investment option offers a similar robo-advised experience, but only for investors who are serious enough to invest in a $3,000 minimum account balance. In general, Vanguard also has a lot more features available for investors who hope to grow their knowledge over time.

While both platforms offer educational resources, those offered by Acorns tend to be a bit more basic than Vanguard's investment lessons, tools, and calculators.

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.