Today, sending money is easier and faster than ever before, especially thanks to online banking platforms that facilitate wire transfers. A wire transfer is a banking transaction initiated through a bank, authorizing it to wire money from one account to another. Several methods are available to help wire money, including using a credit card to send money to a bank account through Wise.

Serving over 16 million people and businesses, Wise has emerged as a leading online banking platform for users worldwide. In this article, we’ll walk you through how to use a credit card to make transfers on Wise, as well as answer some frequently asked questions about using the platform.

To send a wire transfer using your credit card, you'd need to open a wise account. You can get your first transfer for FREE by using the link below:

What We'll Cover

- How to Transfer Money from a Credit Card

- 1. Start the money transfer in the Wise App

- 2. Enter how much money you want to transfer

- 3. Pay for the transfer

- How do I add a credit card to Wise?

- Frequently Asked Questions

- Does Wise work with credit cards?

- Can I transfer money from my personal credit card to my Wise account?

- Will my credit card charge me for using Wise?

- How long does a credit card wire transfer take?

- Why can't I use my credit card on Wise?

- What is the IBAN for a credit card?

- Do credit cards have routing numbers?

- What is the Wise credit card transfer limit?

- Can I accept a credit card payments through Wise?

- How do I link my bank card to Wise?

- Can I transfer money using only my card number and CVV?

- Can I pay my credit card bill with Wise?

- Is Wise Bank the same as TransferWise?

- Can I use Wise as a bank account?

- Can I transfer money between Wise and my bank accounts?

- How do I use Wise for bank transfers?

- How long does transferring money from Wise to a bank account take?

- Does a Wise card have fees?

- Is transferring money using Wise safe?

- Should I use my credit card to pay for a money transfer?

- Is it better to use an international prepaid debit card to pay for a money transfer?

How to Transfer Money from a Credit Card

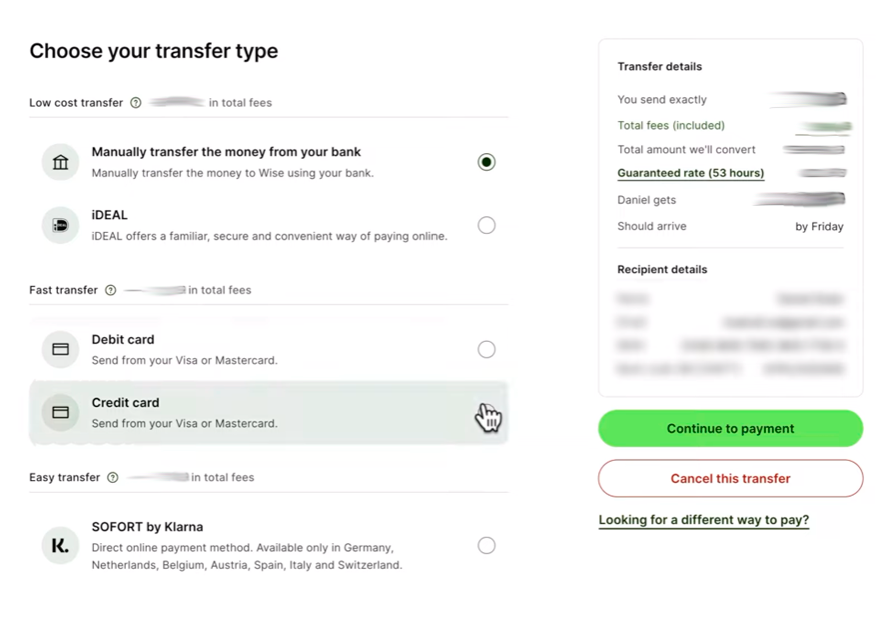

Three simple steps are involved in a wire transfer to your bank account from a Wise credit card. These steps are:

1. Start the money transfer in the Wise App

Open your Wise App and select the option to start a money transfer. Once open, select the person or bank account you want to send the money to.

2. Enter how much money you want to transfer

In USD, enter the money you wish to transfer to your bank account using the Wise App.

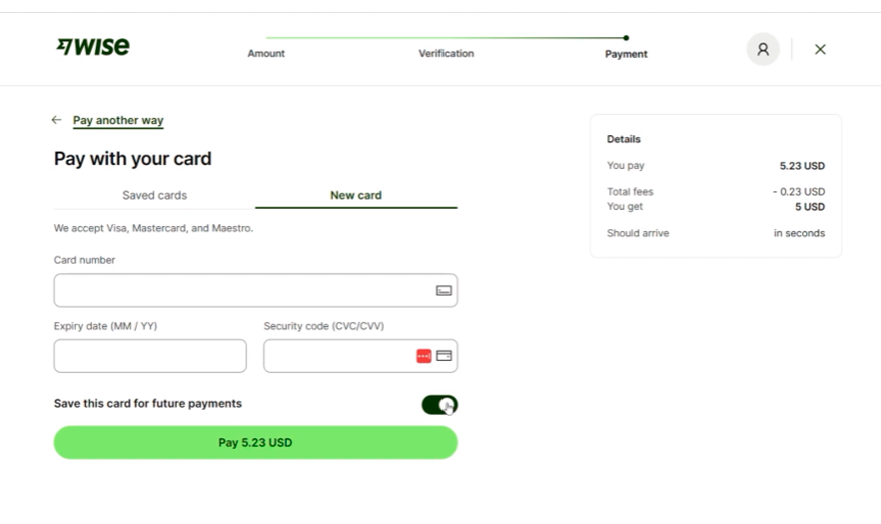

3. Pay for the transfer

Pay for the money transfer using the desired credit card.

How do I add a credit card to Wise?

The following steps can help you add a credit card to your Wise account:

- Go to "Settings"

- Select "Saved Credit Cards"

- You can view, add, update, or change credit cards attached to the account there.

Another way to add a credit card to your Wise account includes the following steps:

- Go to "Settings"

- Select "My Details"

- Select the "Credit Cards" tab

- Select "Add"

- Enter new credit card information

Frequently Asked Questions

Does Wise work with credit cards?

Wise allows users to make payments using a credit card. Depending upon the financial service used through Wise, it is possible to use your credit card to make a payment or send money via a wire transfer.

Can I transfer money from my personal credit card to my Wise account?

It is possible to add money to your Wise account using a credit card; however, using a credit card may incur slightly more expensive fees than if you were to initiate a money transfer or an ACH payment.

Will my credit card charge me for using Wise?

Credit card fees vary depending on the company, the type of card you selected, and the agreed-upon terms and conditions when opening the account. The costs incurred using your credit card to send money to or through Wise will depend upon your credit card.

Additionally, if you do not pay the balance of the credit card before the end of the account's billing cycle, you will be charged interest as agreed upon when you opened the credit card.

How long does a credit card wire transfer take?

In most cases, sending a wire transfer can take up to 24 hours. However, some people have received the funds paid for in the transfer as quickly as a few minutes to less than an hour from initiating the wire transfer.

Why can't I use my credit card on Wise?

If you attempt to use your credit card with Wise and it is denied or comes back ast "not accepted," it could be one of the forms of payment Wise does not accept. For example, if the name on the credit card differs from the name on the Wise account, it cannot be used.

Additionally, US-issued cards can only be used on Wise accounts with an address within the US, and all cards in Argentina, China, and Nigeria are not accepted. Wise also does not accept business cards issued in Russia or Belarus.

What is the IBAN for a credit card?

An International Bank Account Number, or IBAN, is a code to receive or make international payments using our credit card. This number differs from the credit card's account number and may or may not be listed on the card.

If you cannot identify the IBAN for your credit card, contact customer service for guidance.

Do credit cards have routing numbers?

Routing numbers differ from account numbers and are used by banking institutions to identify specific bank accounts. Credit cards do not have routing numbers. However, debit cards with the Visa or MasterCard logos typically have a bank account with a routing number.

What is the Wise credit card transfer limit?

Whether you use a debit or credit card, Wise has a transfer limit of $2,000 every 24 hours and a maximum limit of $8,000 every seven days. However, if it is a local bank transfer, you can wire as much as $1 million or $1.6 million for an international wire transfer using a SWIFT network account.

Can I accept a credit card payments through Wise?

It is possible to get paid through Wise by requesting a payment from the customer. Once the payment request has been initiated, share the link you receive with your customer, and they can make the payment using a debit or credit card. Once payment is complete, Wise sends a notification letting you know you have money available.

How do I link my bank card to Wise?

It is possible to link your US bank account (personal and business) to Wise, making it easier to pay for money transfers. Follow these steps to link your bank card to your Wise account:

- Log into your Wise account

- Click on your profile picture

- Select "Settings"

- Go to "Connected Accounts"

- Click on the bank account you want to link or select "Add New."

- Follow the rest of the prompts on how to finish linking or entering bank details

Can I transfer money using only my card number and CVV?

When using Wise to transfer money from a credit card, you must have the 16-digit credit card number, expiration date, and CVV. You must have two of these, such as the card number and CVV, to complete the transfer.

Can I pay my credit card bill with Wise?

It is possible to pay your credit card bill using Wise; however, using this method could take additional time for the money to go to your credit card company. When paying a credit card using Wise, the money first goes to Wise and then goes to the credit card company.

If you need the money to reach your credit card company sooner, it is best to pay the company directly.

Is Wise Bank the same as TransferWise?

Wise was originally called TransferWise, but as the platform grew, it realized that people needed assistance with their money in more ways than making money transfers. Because of the demand, the company added a multi-currency account, a debit card, and business accounts under Wise.

Can I use Wise as a bank account?

Though Wise is a money service business and not a bank, it is possible to use Wise as an alternative to opening a bank account. Services available through Wise offer everything needed to cover most of your banking needs.

Unlike most bank accounts, Wise does not charge a monthly service fee or require account holders to maintain a minimum balance.

Can I transfer money between Wise and my bank accounts?

It is possible to transfer money from Wise to your bank account. To make the transfer, log into your Wise account, select the amount of money you want to send, and then select the bank account you want to send it to.

How do I use Wise for bank transfers?

Once you have signed up for a Wise account, you can initiate wire transfers and access other money management tools. Follow these steps to conduct a bank transfer using Wise:

- Log into Wise

- Select "Send"

- Select where you want to send the money to come from

- Select transfer type (international, same currency, etc.)

- Enter the amount you wish to transfer

- Select where you want the money to go (bank details, account holder's name, etc.)

- Review transfer details

- Finalize transfer

How long does transferring money from Wise to a bank account take?

Most money transfers from Wise to a bank account take a few seconds to five business days. The time it takes to send the money depends on the currency being sent, and most companies claim money transfers are received within an hour of the transfer being initiated.

Does a Wise card have fees?

Wise does not have monthly fees; each month, account holders can make two ATM withdrawals using a Wise debit card of up to $100 at no charge. After the first two withdrawals, there is a $1.50 USD fee per withdrawal and an additional two percent fee for withdrawals more significant than $100.

Is transferring money using Wise safe?

Using Wise for money management needs, including transferring money, is safe. Adding cash to Wise is held in an established financial institution separate from the company's business accounts. The only way to get access to your money is to use two-factor authentication.

Money deposited into Wise is not FDIC insured, but it is fully protected and guaranteed through the company. Additionally, the company has a dedicated anti-fraud team that works around the clock to safeguard your account and the money deposited.

Should I use my credit card to pay for a money transfer?

Though there are many benefits to using a credit card for a bank transfer, this method of sending money has drawbacks. Using a personal credit card for a bank transfer may incur high fees, which increase the transfer cost. Before using your credit card, check the fees to determine if this is the best way to pay for a money transfer.

Is it better to use an international prepaid debit card to pay for a money transfer?

A prepaid international debit card might be your best option for a money transfer. There are minimal fees, and some, such as Bluebird by American Express, have zero fees. Often, the fees are far less than the interest and credit card fees you may incur paying for the transfer using a credit card.

A Wise account offers many money management benefits, including accessible and affordable money transfer services. If you need to send money, check with Wise and your credit card company to learn all the details, including benefits and fees associated with transfers.

Are you ready to start managing your money with ease? Sign up to Wise now.

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.