At 44 years old, life insurance may be one of the last things you want to think about, but it's the most important. If you haven't gotten it yet, you're looking at more than you could've locked in if you were still in your 20s or 30s.

What We'll Cover

However, there's still time to jump in on the savings before you hit 45! In fact, the cost of life insurance increases anywhere from 4.5% to 9% as you age, and that's assuming you don't run into any health problems over time. This means you can expect huge savings just by securing a policy at 44 instead of 45—let alone waiting longer than that.

Here's what you need to know about getting life insurance at 44 years old, with a sneak peek into some of the best cheap life insurance providers to consider for your age.

Why do I Need Life Insurance at 44?

The truth is, everyone needs life insurance, and there's no better time to do it than now. At 44, you've likely already started a family and got settled into your career. You're also likely looking forward to those years of retirement when you can finally kick back and relax after so many years put into supporting your household and chasing your dreams.

Talking about the possibility of death can be very difficult for you and your family, but it's essential to help guarantee that they are protected if you were to pass away. This is because the cost of dying in the United States can reach as much as $18,978 on average, assuming you're not in a state with higher living wages. For instance, Mississippi is the cheapest place to die at $18,509, and Hawaii is the most expensive at a shocking $41,467. The other 48 states range in between these figures.

3 Tips For Getting Cheap Life Insurance at 44 Years Old

When it comes to your age and getting life insurance, there are some pretty important tips to keep in mind. Believe it or not, shopping for life insurance at 44 can be much different from other years of your life. This is because benefits often fluctuate depending on your age.

Here's what you need to keep in mind at 44.

1. Know your options

A big mistake many make when getting life insurance in their 40s is not knowing their options. This makes it too easy for you to be swayed into an option that does not fit you and your family perfectly. The most relevant for your age are:

- Term life insurance—term policies are at a fixed rate that you secure at 44 (and it doesn't change as you age) but must requalify for after a given period of time. So, they can be great for the short-term rate locked in, but you aren't guaranteed that rate for somewhere from 10 to 30 years, depending on your life insurance provider.

- Whole life insurance—on the other hand, whole life insurance secures your rate for your entire life. This means the premium you pay at 44 will be the premium you pay at retirement and on, assuming that you're keeping up with payments. Whole life insurance also guarantees that your death benefit will be the same when you pass, so you can rest assured your family is taken care of if anything were to happen.

- Universal life insurance—much like whole life insurance, universal is permanent and guarantees your premium and death benefit will remain the same throughout your entire life. The most significant difference to consider here is the flexibility of premium payment amounts and the ability to adjust death benefits as you see fit.

2. Shop Around and Compare

The most important thing you can do when getting life insurance is to consider all of your options. This is an important step in your life, and it will determine how well-off your family will be if something were to happen to you. You want an affordable rate that you can keep up with, and you need to make sure that the death benefit is enough to cover major expenses while taking care of those you love.

3. Make sure you get enough coverage

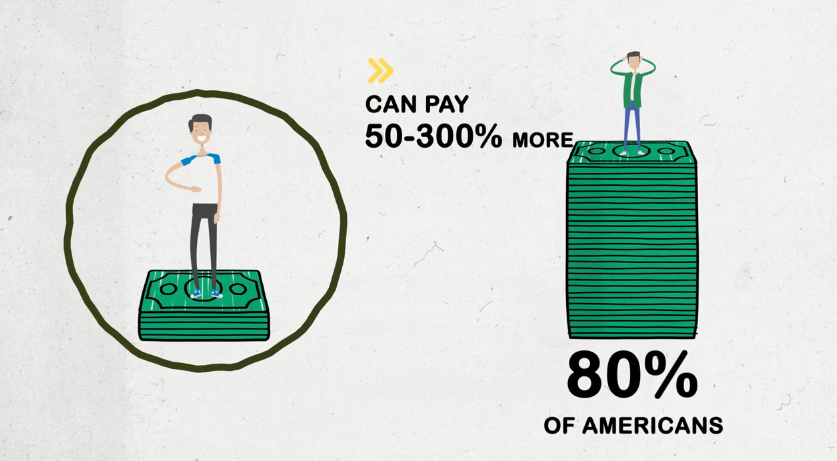

More often than not, Americans who have life insurance are underinsured. Although more than half (59%) of the U.S. population has insured their life, nearly half of those insured are considered underinsured with group insurance by LIMRA research.

Group life insurance is what your job offers you, and there are two problems with it. First, you pay as much as an individual who is high risk in the group, despite being in tip-top shape at 44 years old. Second, you lose it when you move on to a better job opportunity.

7 Cheap Life Insurance Providers You Should Consider at 44 Years Old

At 44 years old, there are at least 7 of the best cheap life insurance providers to choose from. The following is divided up according to term life insurance policies as it is the most cost effective type. However, it's important to note that there are also many options to transition into a more permanent (whole or universal) policy if you wish to in the future.

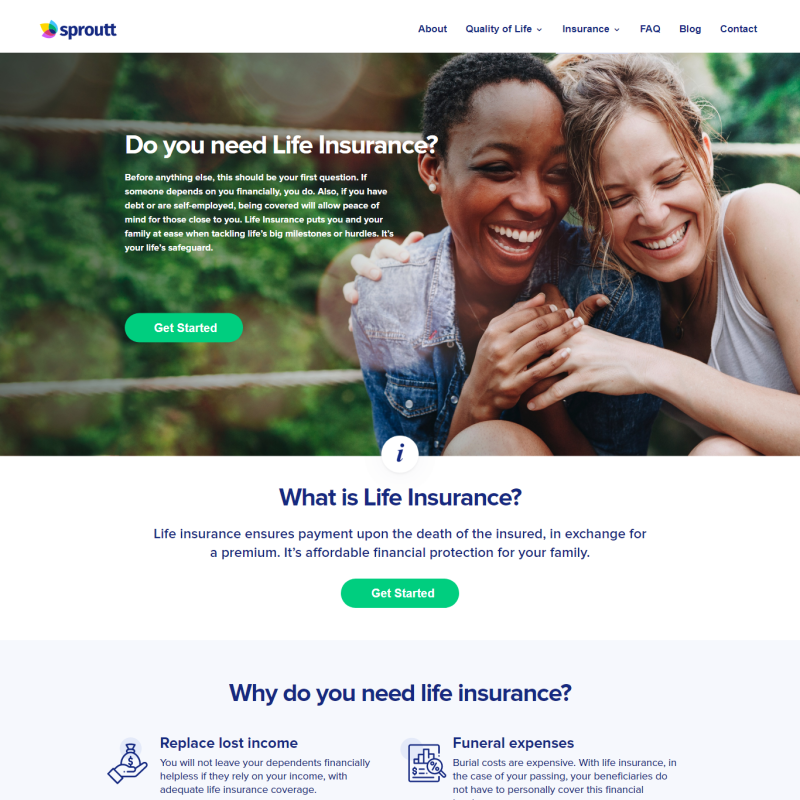

Sproutt

Sprout is a great online life insurance comparison site that takes your personal information and preferences to match you with the best policies and terms to fit your needs. Sproutt is unique because it requires no medical exam, and applications are completed quickly (in just 15 minutes!).

As a 44-year-old male looking for a 20-year policy and without any concerning medical conditions (and without putting additional lifestyle information in to customize recommendations further—which is recommended), you can be looking at $63 a month for $500,000 and $92 a month for $750,000.

Under the same circumstances but for a 44-year-old female, you could expect to pay as much as $47 a month for $500,000 coverage for 20 years and $68 a month for $750,000.

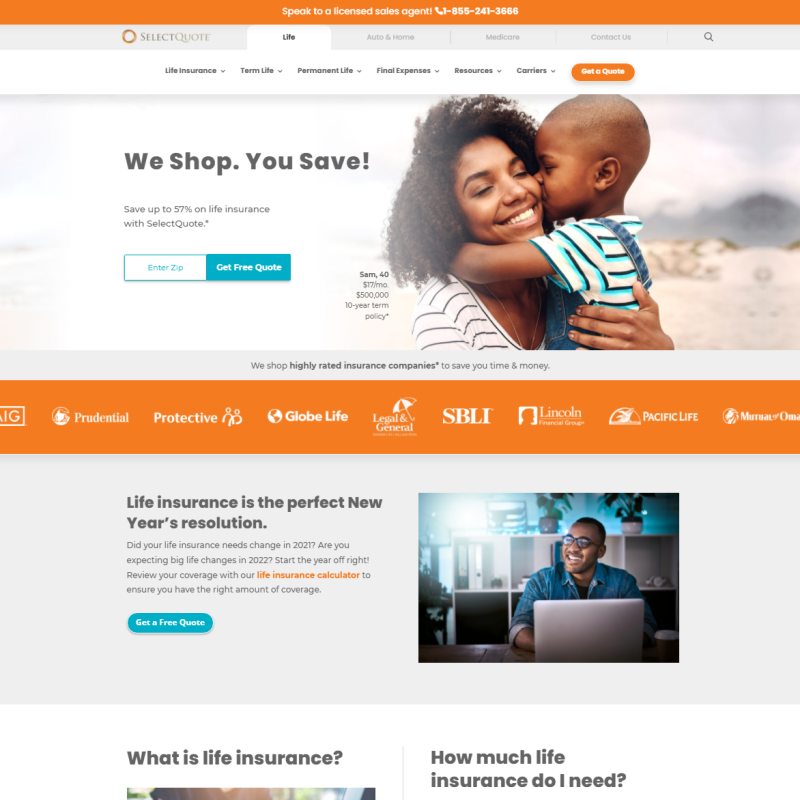

SelectQuote

SelectQuote is another great comparison site to use to get connected with the right life insurance provider. It's great because it has one of the highest coverage amounts, all of your term policies can be easily switched to a more permanent coverage amount when you choose to, and you can renew at the end of each term as well. Coverage amounts go as high as $5 million or as low as $5,000 (and medical exams aren't even required).

Another benefit is that all their top partnered life insurance providers come highly rated, earning an A or higher by AM Best Ratings in most cases.

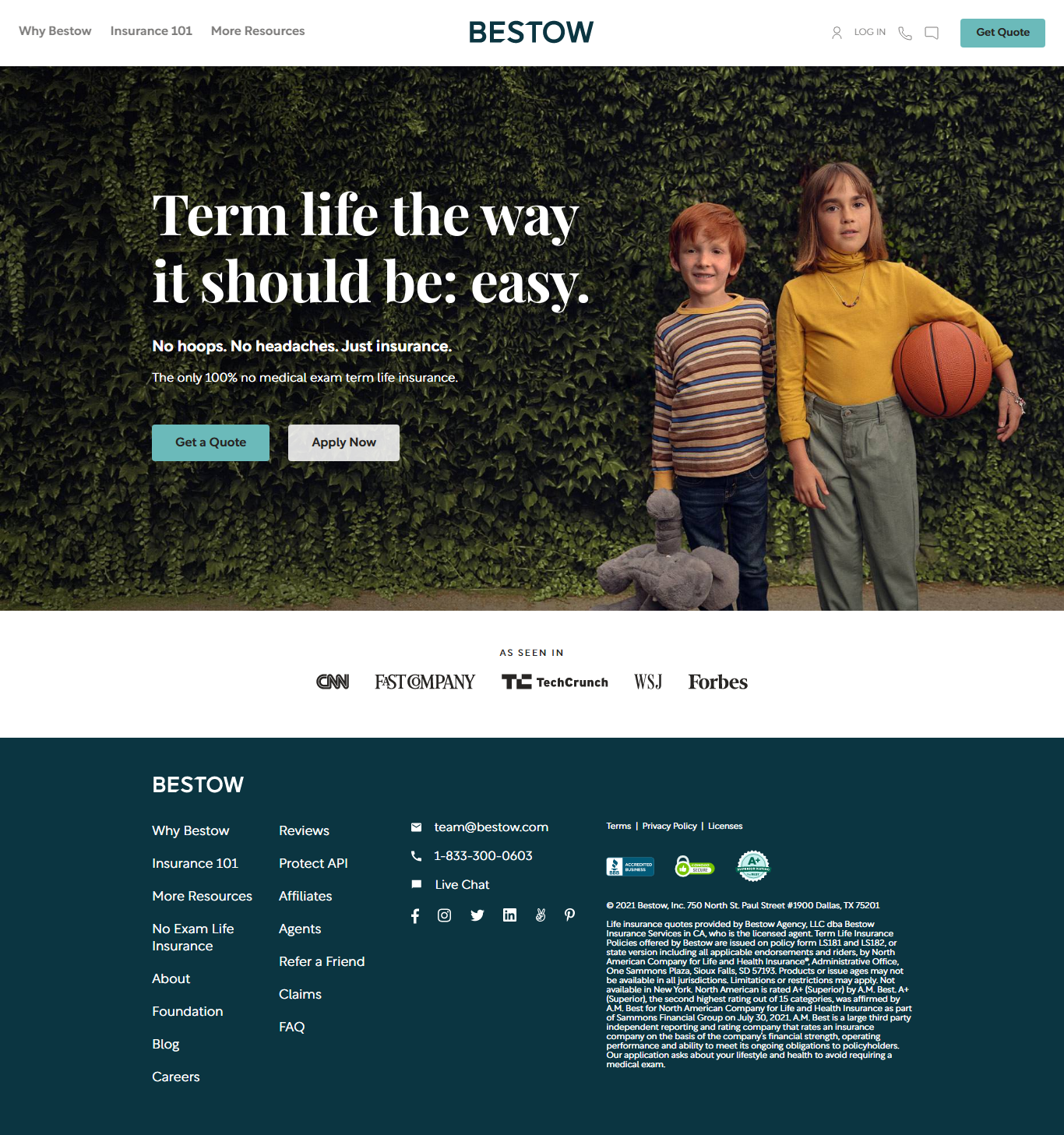

Bestow

For 44-year-old males of good health and without a history of concerning health conditions in the family, you can expect to pay about $47.67 a month for $500,000 coverage for 20 years and $131 for their maximum coverage of $1.5 million.

For 44-year-old females of good health and without a history of concerning health conditions in the family, you can expect to pay about $33.50 a month for Bestow's 20-year, $500,000 coverage, and $88.50 for their maximum coverage amount of $1.5 million.

Ladder

For 44-year-old males of good health and without a history of concerning health conditions in the family, you can expect to pay about $1.18 a day (or about $35.40 a month) for $500,000 coverage for a term of 10 years or $2.73 a day ($81.90 a month) for 25 years. For their maximum coverage amount of $8,000,000, a male policyholder can expect to pay around $12.46 a day ($373.80 a month) for ten years and $38.61 a day ($1,158.30 a month) for 25 years.

For 44-year-old females in good health and without a history of concerning health conditions in the family, the premium rate for $500,000 is $0.98 a day ($29.40 a month) for ten years and $2.15 a day ($64.50 a month) for 25 years. For the maximum coverage of $8,000,000, rates are around $10.60 a day ($318 a month) for ten years and $29.31 a day ($879.30 a month) for 25 years.

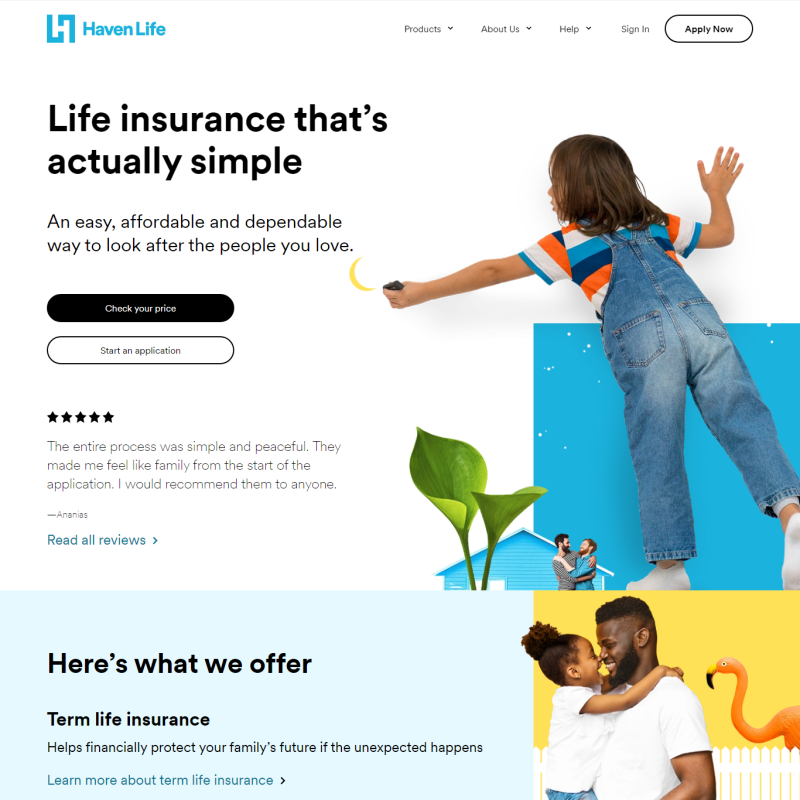

Haven Life

For 44-year-old males of good health and without a history of concerning health conditions in the family, you can expect to pay about $101.82 a month for a 20-year policy covering $500,000 and $279.20 a month to be covered by their maximum of $3,000,000.

For 44-year-old females of good health and without a history of concerning health conditions in the family, you can expect to pay about $76.54 a month for $500,000 coverage in a 20-year policy and $211.25 a month to be covered by their maximum of $3,000,000.

Ethos

For 44-year-old males of good health and without a history of concerning health conditions in the family, you can expect to pay about from $58 to $91 for a 20-year policy and coverage at $500,000. An estimate of $213 to $345 is given for 20 years and coverage at their maximum of $2,000,000.

For 44-year-old females of good health and without a history of concerning health conditions in the family, you can expect to pay around $45 to $69 a month for a 20-year policy and a coverage amount of $500,000. For their maximum coverage amount of $2,000,000, you can expect anywhere from $159 to $258 a month for 20 years.

LeapLife

LeapLife is another site you can access online for life insurance comparisons that best fit your needs. The benefits of LeapLife include shopping up to $5 million in coverage and saving as much as 40%.

The top offer for a 44-year-old male without any specific health conditions or lifestyle answers is about $39.68 a month for a 20-year policy and $500,000 coverage. That number increases to $344.11 for a 20-year policy and $5,000,000 coverage. For a 44-year-old female, that estimate is decreased to $33.50 a month for 20 years and $500,000 coverage, and $282.06 a month for $5,000,000 coverage.

Premiums for People aged 44 Will Range Depending on the State You're in

Assuming you obtain a 20-year policy with coverage at $500,000 and are in average health, the average premium rate for the following states will be:

- California — $56 a month or $668 annually

- Florida — $52 a month or $627 annually

- New York — $56 a month or $675 annually

- Texas — $53 a month or $633 annually

- Kentucky — $50 a month or $599 annually

- Ohio — $50 a month or $599 annually

- Pennsylvania — $55 a month or $659 annually

Cheap Life Insurance Quotes by Age

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.

![Can You Get Life Insurance for Your Parents? [Complete Guide]](/assets/images/4195a596c9c2e2afdae7712685f340fc.png)