According to insurance professionals, purchasing life coverage from cheap life insurance providers for 36-year-olds when you're still in your 30s is a smart financial decision. At 36 years, you're still enjoying good health and will likely get insurance plans at affordable rates. Additionally, you probably have a family, which means you have dependents relying on your income, and the proceeds from your coverage can replace your income once you transition to retirement, when your kids move on and become financially stable.

What We'll Cover

- Why Is Now the Best Time to Start Researching Cheap Life Insurance Providers for 36-Year-Olds?

- Helpful Tips When Choosing From the Best Life Insurance Providers for 36-Year-Olds

- Analyze Your Needs

- Buy Term Life Coverage From One of The Best Affordable Life Insurance Providers for 36-Year-Olds — Then Convert It

- Best and Cheapest Life Insurance Companies for 36-Year-Olds

- The Average Term Life Insurance Premiums by State for 36-Year-Old Males and Females

There are several financial responsibilities that you need to cater to when you're in your pivotal decades of your 30s. Being at an age when insurance costs are relatively lower, you have plenty of affordable life insurance providers for 36 year olds. Also, you can leverage online life insurance marketplaces to compare rates from various insurers to find the one best tailored to your financial needs. If you're ready to start shopping around for life coverage, click here to get highly competitive estimates.

Why Is Now the Best Time to Start Researching Cheap Life Insurance Providers for 36-Year-Olds?

Buying a life insurance plan is the most impactful and practical financial decision you can make, and there are reasons to back that fact.

You Have a Family

In your 30s, the chances are that you've started a family, are getting married, and have secured a mortgage to help you purchase a home. You also may have other people like your spouse, children, and aging parents who are financially dependent on you. In case you pass on – which we pray you don't – or an unexpected life event, such as an accident or illness, halts your income, your loved one will receive a death benefit. They can offset your debts, pay monthly bills, and continue living a comfortable life without falling into financial ruin.

The Costs of Life Insurance Coverage Is Lower

Insurance companies calculate life coverage costs based on mortality; the higher the age, the higher the rates. Buying a plan from cheap life insurance providers for 36-year-olds now is a smart move. If you wait until you add one or two more decades to your age, you'll incur increased costs.

As a matter of fact, insurance costs increase by 8% every year. That means, by purchasing a term life plan today, you will pay less for a life policy than you would have at 46 and 56 years old. Apart from that, you're in excellent health in your 30s, unlike in your 40s or 50s when a new diagnosis like high blood pressure, anxiety, and high cholesterol may hurt your chances of getting low-priced life insurance.

Although purchasing a whole life plan may not be necessary at your age, securing term life coverage when you're healthy and young guarantees a more stable future with more financial options in the long term.

You're Making More Money Now

People start their careers in their 20s, and that may not have come with as much income because you were still trying to master and gain experience in your field. In your mid-30s, you've probably advanced in your profession and are making more money.

You never know what tomorrow holds, and buying term life coverage now answers some of the "What if..?" questions in life. If anything were to occur to you, the funds from your insurance coverage could replace a significant portion of your lost income. Experts advise that it would be best to purchase a life policy with a death benefit equal to between five and ten times your current salary. There are pay disparities due to the life insurance gender gap among men and women, but purchasing a life plan now (when you can afford it) alleviates financial uncertainties in the future.

Helpful Tips When Choosing From the Best Life Insurance Providers for 36-Year-Olds

Purchasing life insurance coverage can be challenging and confusing, especially if you're a first-timer. However, doing due diligence helps you understand the life insurance nitty-gritty for 36-year-olds.

Analyze Your Needs

When dependents rely on your income, you want to ensure that they are financially secure if anything were to hurt your income flow. That's when a needs analysis comes to play.

Performing a needs analysis is the best means of determining the amount of life coverage you need. You can calculate your needs when managing risks in three ways: the human life value approach, based on future earnings. The capital retention approach depends on a policy's death benefit designed to provide income to cater to your surviving family members' living costs. Then a financial needs model looks into income replacement needs.

Financial experts recommend analyzing your life insurance needs using the human life approach, which is based on income earnings over a specific period. It's impossible to put a value on human life, but it's possible to calculate their economic value over a given time. That's what determines the financial cushioning it gives your loved ones.

Buy Term Life Coverage From One of The Best Affordable Life Insurance Providers for 36-Year-Olds — Then Convert It

For someone below 45 years, term life coverage is the most practical plan to cover basic life needs, like income replacements and debts. For instance, a mortgage is a need that will go away soon, and term life from one of the top cheap life insurance providers for 36-year-olds offers an affordable means to cover such a need.

On a positive note, most insurers attach a coverage convertibility privilege to their term policies. That allows young policyholders to convert their time life coverage into permanent life plans as their financial goals change. With that understanding, you need to find inexpensive life insurance companies and ensure they have a high dividend and whole-life policy performance when the need to convert comes.

Best and Cheapest Life Insurance Companies for 36-Year-Olds

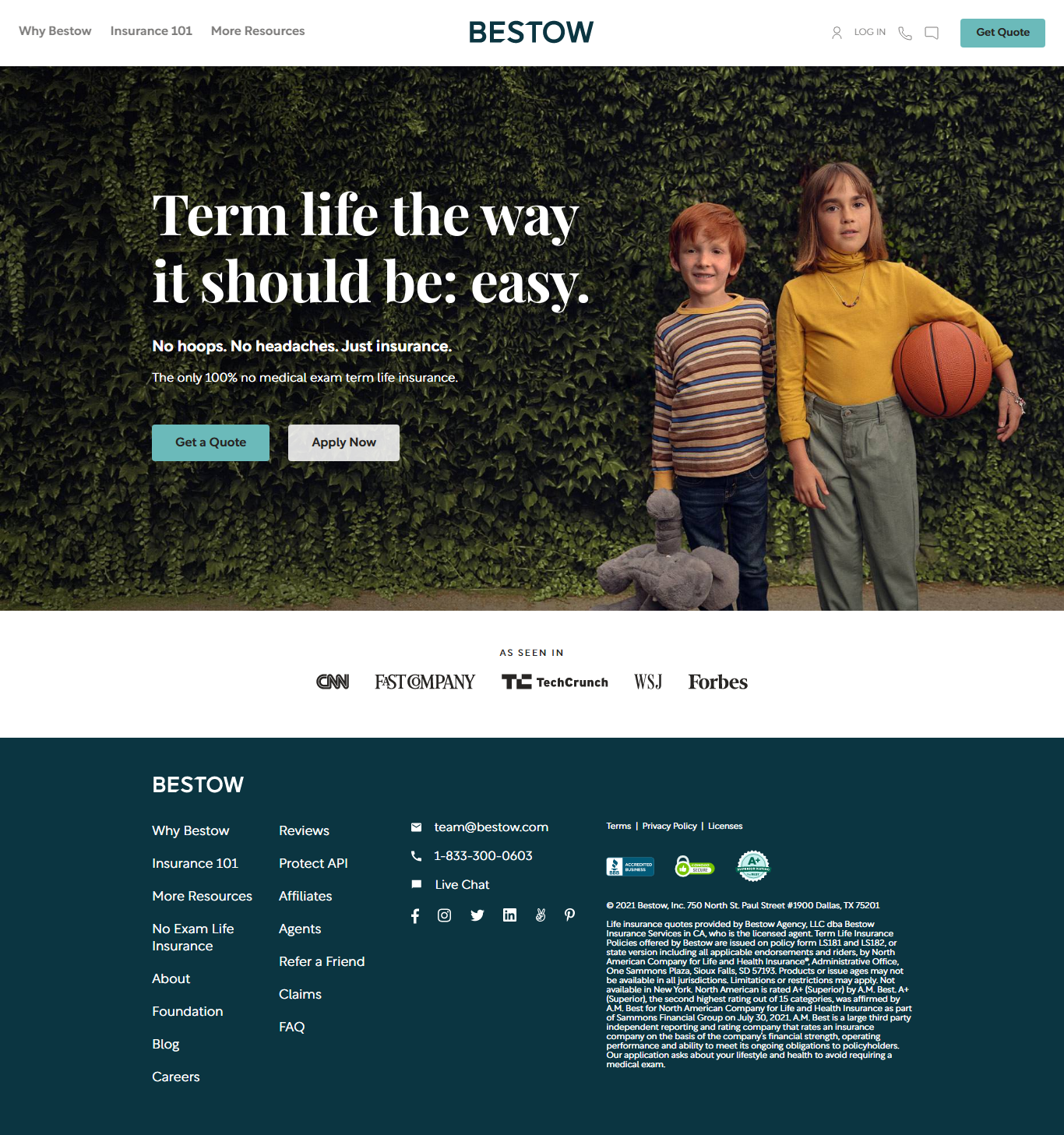

Bestow

A relative newcomer in the insurance industry, Bestow was established to simplify life insurance shopping. It currently provides term life plans from 10-30 years and $50,000-$1.5 million in coverage. With this insurance agency, you can get quotes and submit an online application with a 30-day money-back guarantee and no medical examination. The only disadvantage is that Bestow does not offer policies to New Yorkers.

A healthy, non-smoking, 36-year-old female can expect to pay the following life insurance premiums:

- $15.17 per month for $500,000 in coverage for a 10-year term

- $30.67 per month for $800,000 in coverage over a 20-year term

- $101.00 per month for $1.5 million in coverage for a 30-year term

A 36-year-old male can expect to pay the following life insurance premiums:

- $24.33 per month for $500,000 in coverage for a 10-year term

- $42.67 per month for $800,000 in coverage for a 20-year term

- $147.38 per month for $1.5 million in coverage for a 30-year term

State Farm

Although State Farm started as an auto insurance company in 1922, it also provides life insurance coverage. Customers can be confident that it offers strong policies due to its long history in the sector. It offers term life plans with term lengths between 10 and 30 years with a 10-year interval and $100,000 minimum coverage. The advantages of State Farm life policies are that you can purchase term life and permanent life coverage, get customization options, and access an extended age limit of up to 75 years.

A 36-year-old female can expect to pay the following life insurance premiums:

- $27.84 per month for $500,000 in coverage for a 10-year term

- $48.54 per month for $750,000 in coverage for a 20-year term

- $91.39 per month for $1 million in coverage over a 30-year term

A 36-year-old male can expect to pay the following life insurance premiums:

- $31.74 per month for $500,000 in coverage over a 10-year term

- $60.92 per month for $750,000 in coverage over a 20-year term

- $131.39 per month for $1 million in coverage over a 30-year term

Sproutt

Sproutt is not an insurance agency but rather an online marketplace for insurance quotes and sales. It leverages powerful AI software that helps you obtain the perfect, customized plans for your life insurance needs. It's the best online insurance shopping website for 36-year-olds as it's geared toward young individuals at an early family stage or married couples. The good thing with Sproutt is that it tailors life insurance plans based on primary factors like age and income and personal lifestyle and preferences, such as driving behavior, lifestyle, travel needs, and many more. You also don’t need to take a medical exam, and you can have access to human advisors if need be.

SelectQuote

As another online insurance marketplace, SelectQuote lets you shop around for the best companies with cheap life policies. It focuses on bringing you personalized plans with estimates for term life and permanent life plans with a maximum of $5 million in coverage. SelectQuote also provides convertibility privileges to its term life policies with no medical exam required. Policyholders can secure term life plans with death benefits, paid out only if you pass away during active coverage.

Haven Life

Haven Life Insurance is another tech-focused insurer that offers term life insurance without a medical report. It caters to individuals of 18 to 64 years, but those above 60 can obtain up to $1 million coverage. Haven's term life policies cover 10 to 30 years, with a 5-year interval. You can get $100,000 to $3 million in coverage with affordable monthly premiums. Unlike other insurance agencies, the youngest Haven customers enjoy commission-free term life policies.

A 36-year-old female can expect to pay the following life insurance premiums:

- $16.74 per month for $500,000 in coverage over a 10-year term

- $36.41 per month for $750,000 in coverage over a 20-year term

- $109.25 per month for $1.5 million in coverage over a 30-year term

A 36-year-old male can expect to pay the following life insurance premiums:

- $19.38 per month for $500,000 in coverage over a 10-year term

- $42.32 per month for $750,000 in coverage over a 20-year term

- $131.40 per month for $1.5 million in coverage over a 30-year term

Banner Life

Ranked by USNews as one of the cheapest life insurance companies in 2021, Banner Life provides term life coverage with monthly rates under $47 per month. Owned by insurance bigwig Legal & General, Banner Life provides life policies with an extended term of up to 40 years, and you can secure $100,000 in coverage as the minimum. One upside to purchasing Banner Life insurance is that it pays out approved claims within a single day. Also, you can secure your preferred underwriting class even with a family medical history of cancer.

A 36-year-old female can expect to pay the following life insurance premiums:

- $13.60 per month for $250,000 in coverage over a 10-year term

- $29.19 per month for $700,000 in coverage over a 20-year term

- $100.12 per month for $1.5 million in coverage over a 30-year term

A 36-year-old male can expect to pay the following life insurance premiums:

- $10.41 per month for $250,000 in coverage over a 10-year term

- $24.38 per month for $700,000 in coverage for a 20-year term

- $79.51 per month for $1.5 million in coverage over a 30-year term

Ethos Technologies

Ethos ranks among the top tech-focused and cheap life insurance providers for 36-year-olds. They have some of the most affordable and accessible policies. Shoppers can file their insurance applications entirely online within minutes. The expedited underwriting process includes health questions without having to go for a medical examination. Term life plan options can be as long as 10, 15, 20, 25, or 30 years, and you can get coverage from $20,000 to $3 million.

A 36-year-old female can expect to pay the following life insurance premiums:

- $32 per month for $500,000 in coverage over a 10-year term

- $86 per month for $1 million in coverage over a 20-year term

- $176 per month for $2 million in coverage over a 30-year term

A 36-year-old male can expect to pay the following life insurance premiums:

- $39 per month for $500,000 in coverage over a 10-year term

- $106 per month for $1 million in coverage over a 20-year term

- $298 per month for $2 million in coverage over a 30-year term

The Average Term Life Insurance Premiums by State for 36-Year-Old Males and Females

The following are the average monthly life insurance premiums for $500,000 in coverage for 20 years for 36-year-olds:

- California: $19.21 for females and $34.52 for males

- New York: $19.65 for females and $23.18 for males

- Texas: $24.23 for females and $28.28 for males

- Illinois: $18.87 for females and $22.31 for males

- Pennsylvania: $21.42 for females and $28.92 for males

- Ohio: $20 for females and $23.70 for males

- Michigan: $18.87 for females and $23.31 for males

Cheap Life Insurance Quotes by Age

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.

![Can You Get Life Insurance for Your Parents? [Complete Guide]](/assets/images/4195a596c9c2e2afdae7712685f340fc.png)