Advertiser Disclosure: Top-Best.com has partnered with various providers to offer a wide range of credit card products on our website. Both our website and our partners may receive commissions from card issuers. As part of an affiliate sales network, Top-Best.com receives compensation for directing traffic to partner sites. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers.

Most Americans suffer from a low credit score, which has several negative effects, including higher interest rates and the inability to get unsecured loans/credit. According to Experian.com, the average credit score in the United States in 2021 was 714, which falls within the average credit scores for moderate to middle-income individuals.

What We'll Cover

- What is a Good Credit Score?

- My Credit Score Is 550 (or Less), How do I Raise It?

- If You Have Lots of Collection Accounts

- May You Have Multiple Late Payments

- Overextended Credit Usage

- Dispute False Information

- Apply for a Credit Card or Get a Secured Card

- Get a Credit Builder Loan

- Why is My Credit Score Stagnant?

- Blessed Credit

- Ovation

- Lexington Law

- How to Improve Credit Score in 6 Months?

- How to Increase Credit Score Faster Than Six Months?

- What's the Average Minimum Time that Someone Can Expect to Take to Start Seeing Improvements?

- Average credit score after first 6 months

- Conclusion

Average credit score brackets, according to the Federal Reserve Bank of New York, are:

- Low income = 658

- Moderate income = 692

- Middle income = 735

- Upper income = 774

Understanding how credit scores get calculated can improve your score usually between six months and three years. However, you can start seeing some improvements as soon as 90 days (3 months), but you have to be aware that, since every person has different situations, the process of repairing your credit score is very individual. Therefore, time, actions needed (and effort) will depend on many factors like: your starting score, financial situation, and of course, how proactive and committed you are with improving your credit.

What is a Good Credit Score?

Generally, good credit scores are those between 670 and 739, and scores from 580 to 669 are considered fair. Anything under 579 is regarded as a poor credit rating. Excellent credit ratings range from 740 to 799, and perfect credit scores are 800 and up.

Scores are determined by your credit behaviors, including balances, credit applications, payments, and more. It gives potential creditors an idea of how well you handle debt and determine the level of risk they will take should they give you a loan or credit card. Good credit scores may qualify you for most lines of credit you apply; however, you may still appear as a greater risk than someone with a very good or excellent score.

My Credit Score Is 550 (or Less), How do I Raise It?

You can do several things to raise your credit score, including disputing false information, paying off collection accounts, and lowering your percentage of credit used. If you haven't got your credit report yet, you can get it from all three credit bureaus - Experian, Transunion, and Equifax for free. Free copies of credit reports are available either through their websites or through AnnualCreditReport.com.

Now that you know where your credit history stands, let's get started and find out what you may need to do. Here are some ways to help you raise your credit score depending on different factors:

If You Have Lots of Collection Accounts

If you have a lot of accounts in collection, first verify it is a valid debt and that you owe it. Then, reach out and try to settle with the collection company in addition to having the item removed from your credit report. Removing the article will help boost your credit score. Even if the company doesn't agree to terminate the account, paying off can help raise your credit score.

May You Have Multiple Late Payments

If your credit report score has dropped because of multiple late payments, it is time to sit down, create a budget, and start making payments on time. Setting up automatic payments can also help pay bills on time. Paying bills on time accounts for 60 to 70 percent of your credit score. If you start paying all debts on time, you may see an improvement in your score as soon as a few billing cycles.

Overextended Credit Usage

When rebuilding your credit, keeping a watchful eye on your credit utilization ratio, and keeping it low is vital. This ratio determines the amount of credit you use versus the total amount of credit you have available. Keeping this ratio below 30 percent can help improve your credit score and make you look more appealing to lenders.

Dispute False Information

When reviewing your credit reports, check to see if there are any errors on the reports. Common errors may include:

- Accounts that are not yours

- Late payments that were paid on time

- Accounts with paid-off balances still showing as having a balance

Take time to dispute any information on your credit report that is incorrect. Depending on the item, once removed, it can raise your score anywhere from 50 points to 100 points (or more).

Apply for a Credit Card or Get a Secured Card

Though it may drop your score initially by a few points, applying for a credit card or getting a secured card can help add a new line of credit and diversify your credit types. In addition, with usage and on-time payments, a new card can help boost your score as soon as six months to one year. Here are some great credit card options that will help you increase your credit score when using them responsibly:

Great for those with limited or no credit history:

Citi® Secured Mastercard®

If you're new to credit and/or have no credit history, the Citi Secured credit card can be a great option to start with. You will be able to start building your credit and in the long run, upgrade to an unsecured card after paying on time for the first 18 months. The card requires a security deposit ($200 - $2,500), does not have an annual fee, and has a 26.74% variable APR.

All information about Citi® Secured Mastercard® has been collected independently by Surfky.com. Citi® Secured Mastercard® is no longer available through Creditcards.com.

Perfect for those needing to rebuild their credit

Self – Credit Builder Account + Secured Visa® Credit Card

The Self Credit Card, is an excellent option for individuals looking to build or rebuild their credit. It's especially valuable for those with limited credit history or a less-than-stellar credit score.

One standout feature of the Self Credit Card is the ability to monitor your credit score through the Self app. This feature can be a powerful tool for those actively working on improving their financial health. However, it's important to note that this card does not offer cash-back rewards.

The APR for cash advances with the Self Credit Card is typically on the higher side, so it's essential to use this card responsibly and primarily for building credit. If you're focused on credit improvement, this card can be a valuable asset.

Chime Credit Builder Secured Visa® Credit Card

This card is an amazing option for those that are looking to quickly rebuild their credit scores without worrying about annual fees or high-interest rates, not even paying on time your card as this car offers a great feature called "Safe Credit Building" that allows you to set up the payment of your card's balance automatically. Additionally, the Chime Credit Builder card does not require a minimum deposit or credit check to apply (so you don't have to worry about a hard pull either) and will report to the three major credit bureaus.

StellarFi Credit Builder Account

StellarFi offers a credit card that caters to individuals with varying credit histories. Like Bank of America, the credit limit for this card is determined based on your creditworthiness. While it may not offer the same high credit limits as Bank of America, it can still provide a reasonable credit line for qualified applicants.

StellarFi's focus on customer service and user experience sets it apart from some other credit cards. They aim to make managing your credit card as convenient as possible through their mobile app and online platform. However, similar to the Self Credit Card, it lacks cash-back rewards.

The APR for cash advances with StellarFi is competitive for cards designed for those with fair to good credit. If you're looking for a straightforward credit card to help manage your finances and build credit, StellarFi is a solid choice.

Mission Lane Cash Back Visa® Credit Card

The Mission Lane Visa Credit Card offers a cash credit line similar to the Bank of America Customized Cash Rewards Credit Card. This card targets individuals with fair to good credit, making it accessible to a broader range of applicants.

One notable feature of this card is the cash-back rewards program, allowing you to earn cash back on your purchases. The specific rewards rate may vary, but it's a valuable perk for cardholders who want to get something back from their spending.

The APR for cash advances with the Mission Lane Visa Credit Card is in line with industry standards for cards in its credit category. Responsible credit management is essential to avoid high-interest charges.

Petal® 1 "No Annual Fee" Visa® Credit Card

The Petal 1 Credit Card is a unique offering in the world of credit cards. Unlike traditional cards, Petal uses an alternative underwriting process that considers your banking history and income to determine your creditworthiness. This approach can benefit individuals with limited credit history.

One significant advantage of the Petal 1 Credit Card is the absence of annual fees and foreign transaction fees. It also offers a mobile app to help you manage your finances and track your spending. However, similar to other cards in this group, it does not provide cash-back rewards.

The APR for Petal 1 varies based on your creditworthiness, but it tends to be competitive compared to other cards designed for those with limited credit history. If you're looking for a card that prioritizes simplicity and low fees while helping you build credit, Petal 1 is a solid choice.

Capital One QuicksilverOne Cash Rewards Credit Card

This Capital One QuicksilverOne card is top-notch for those with fair credit (580+) needing to rebuild their scores, as this card offers the opportunity to enjoy a generous rewards program and many of the same benefits offered by cards for those with good-excellent credit scores.

| Rewards | an unlimited 1.5% cash back on every purchase and 5% on hotels and rental cars booked through Capital One Travel |

| Annual Fee | $39 |

| APR | 30.74% Variable |

PREMIER Bankcard® Mastercard® Credit Card

The PREMIER Bankcard won't require you to have a good credit score to apply (500+) and has an easy application process. This is a great unsecured option for those that would like to build their credit

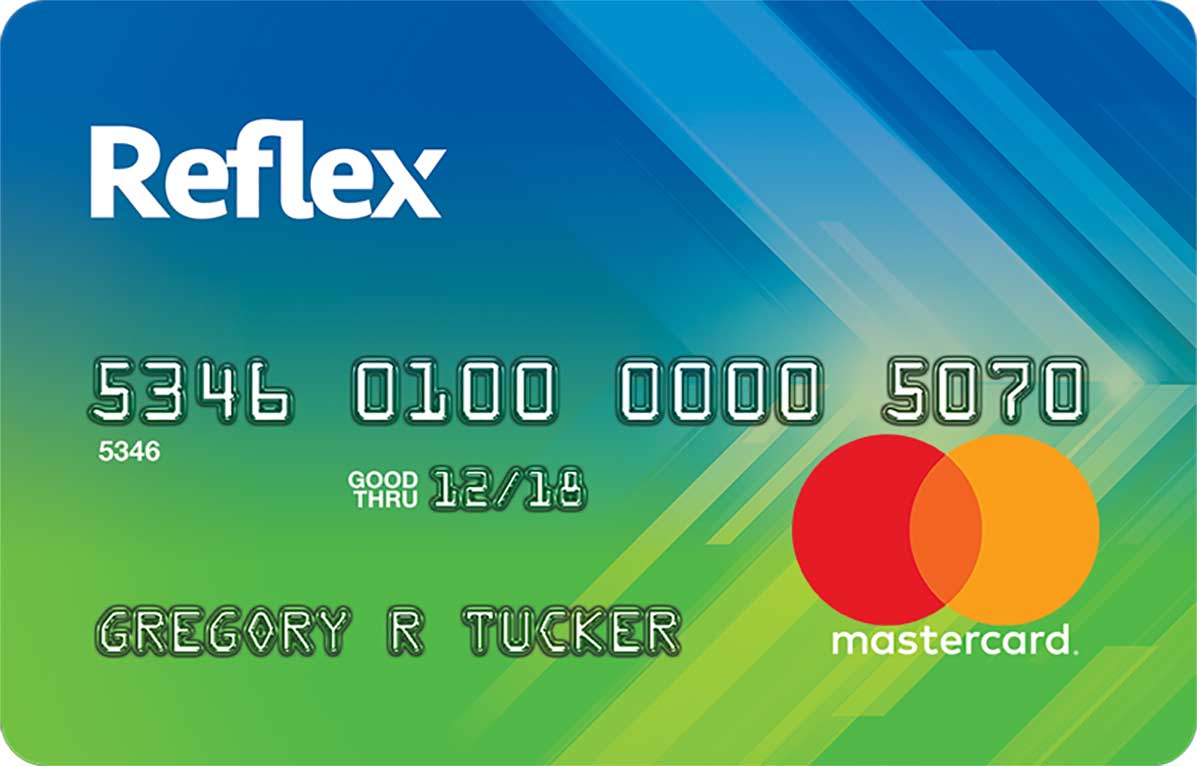

Reflex Mastercard® Credit Card

One of the great advantages of the Reflex Mastercard is that you can check if you're pre-qualified without impacting your credit score. Additionally, there's no minimum credit score to apply, can have up to $1,000 credit limit as well as the option to increase it up to $2,000 after making all payments on time during the first 6 months, and reports to the 3 major credit bureaus.

Get a Credit Builder Loan

Set up a credit builder loan to help boost your credit score fast. When you make your payments on time, these loans report to the credit bureaus, and your money is put into a savings account. At the end of the loan, you will have several positive marks on your credit report and money in the bank.

You may also want to read: Best Personal Loan for Credit Card Debt Consolidation

Why is My Credit Score Stagnant?

It can be highly frustrating to log in to see if your credit reports remain stagnant and if there are no changes to your credit score. Unfortunately, this feeling is very common among those trying to improve their credit score for a specific purpose, including buying a new car or home or paying less interest on future personal loans. Some reasons your credit score may not be improving include any of the following reasons:

- You have missed a few payments

- Your overall credit usage is high

- You have a limited credit history

- You have applied for multiple loans or credit cards

- You do not have a variety in the type of credit accounts

- A creditor keeps incorrectly reporting information

How to Prevent Your Credit from Becoming Stagnant?

If you are trying to improve your credit but are noticing it is remaining stagnant, or even if you're not sure where to start and feel that you need guidance, it might be time to hire the help of one of the three best credit repair services.

Some credit repair service companies include Blessed Credit, Lexington Law, and Ovation by LendingTree. Even if you have a credit score stuck at 750, it is possible to bring that score up in a short period.

Blessed Credit

Blessed Credit is definitely our Top 1 option after reviewing many credit repair services on the market (and there are a lot out there) as the company allows you to start your journey to a better credit score and financial status without breaking the bank. The company offers the cheapest premium rate between our picks, yet a great and complete service that will deliver you a hassle-free process. Additionally, your first consultation is FREE.

- Direct access to your case status 24/7

- They will do the work

- Credit monitoring not included (there's an additional fee if you want to include it)

- No credit counseling

Ovation

- Multiple credit repair options

- Direct access to advisors 24/7 support

- No guarantee it will be effective

- No credit counseling

Lexington Law

- A law firm is handling your credit repair

- They have a proven track record

- They offer multiple plan options

- More expensive

- Not accredited by the BBB

- Issues with business ethics

How to Improve Credit Score in 6 Months?

If you recently discovered how low your credit score is, you may feel there is a sense of urgency to get the score back to good and excellent standing. It is possible to start seeing an improvement in your credit score in six months. How fast and how much the score improves depends significantly upon the score you began at and what was causing the low score in the first place.

Understand what affects your credit score, such as missed payments, late payments, using more than 30 percent of available credit, no credit history, and applying for multiple lines of credit in a short time. Once you know what is causing your score to be low, create a plan to target those items. Whether making payments on time or removing inaccurate information, you will start seeing an improved credit score as quickly as a couple of months and an even better score in six months.

How to Increase Credit Score Faster Than Six Months?

On average most people working to improve their credit scores start seeing significant increases within six months. It is possible to see your credit score improve faster, but that depends on what is causing your low score in the first place. Simple tasks to do to help raise your credit score more quickly than six months include:

- Dispute inaccurate items and have them removed

- Get added to someone else's credit card (who pays their bills on time)

- Stop applying for new credit

- Start paying bills on time

- Make a large payment to pay down credit card debt

- Ask for a credit line increase

- Pay off collections and have them removed

What's the Average Minimum Time that Someone Can Expect to Take to Start Seeing Improvements?

The average time someone can expect to see an improvement in their credit scores is after three to six months of proactively working to improve their credit history. However, it may take as much as a year to two years to see a significant improvement in scores. In rare cases, depending upon what was dropping the credit score, some people have seen an improvement as early as 30 days after starting.

One example is if you are 30 days late on your mortgage payment it can cause a delay of six months to two years for your credit to recover from that missed payment. Therefore, getting a 700 credit score in 90 days may be more realistic than trying to improve your score within 30 days.

Average credit score after first 6 months

Every person is different, and the average credit score after working on credit repair can vary among individuals. Everything from the initial score, what is causing the score to drop, and what you do to fix the low score can determine how much your credit score can rise after six months. On average, those who work diligently can raise their credit score as much as 100 points within the first six months.

How Long Can It Take to Build a Credit Score Of 800-850?

Though there are ways to quickly boost your credit, realistically, depending on your score when you start with credit repair, it can take up to four or more years. The most commonly asked question is, "How to get a 700 credit score in 6 months?" And is it possible to "Get a 700 credit score in 90 days?" Improving your credit score is not impossible, but it may take longer than six months, especially if you start at a significantly low credit score. Below is a chart with the average time it takes to get your score up:

| Initial Score | Avg. time to reach 700* | Avg. time to reach 750* | Avg. time to reach 800* | Avg. time to reach 850* |

| 300 | 2-3 years | 2.5 -3 years | 3-4 years | 4 years |

| 350 - 400 | 2+ years | 2-3 years | 3 years | 3-4 years |

| 450 - 500 | 18 months - 2 years | 2 - 3 years | 3+ years | 3-4 years |

| 550 - 600 | 12-18 months | 1-2 years | 2+ years | 2-3 years |

| 650 - 700 | – | 3 months - 1 year | 1 year | 1-2 years |

| 750 | - | - | 6 months - 9 months | 1 year to 1.5 years |

Conclusion

Be proactive and monitor your credit so you can jump on anything that gets reported to the credit bureaus, which may negatively affect your credit. Additionally, if you need some guidance or feel that it would be easier for you to have someone helping you through the process, you can try one of the top 3 credit repair services mentioned above.

Depending on what your situation is, with some proactive actions and staying on top of your credit reports, it is possible to improve your credit score within three months to one year.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

To find all the details about the terms and conditions of an offer, check the online credit card application. We put a lot of effort to present you accurate and up-to-date information; however, we do not guarantee the accuracy of all credit card information presented.

Editorial Disclosure: All reviews/opinions expressed here are author's alone, and have not been reviewed, approved, or otherwise endorsed by any advertiser included within our content. The information presented on this page is accurate as of the posting date; however, some of the offers mentioned below may have expired. Check the issuer's website for the most recent information.

Advertiser Disclosure: Top-Best.com has partnered with various providers to offer a wide range of credit card products on our website. Both our website and our partners may receive commissions from card issuers. As part of an affiliate sales network, Top-Best.com receives compensation for directing traffic to partner sites. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers.

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.